As of early June with the S&P 5001 breaking through 6,000 following the last two months of market volatility since 'US Liberation Day', the old market saying “Sell in May and go away” comes to mind.

This saying has been attributed to a time when London's financial district left to spend the summer elsewhere and returned to the capital markets in September. The full saying is “Sell in May and go away, do not return until St. Leger's Day” which is an English horse race first held in September 17762. Whilst that age has passed, the saying lives on and does ask the question, can we time markets in order to increase our returns by selectively being out of the market.

Market timing involves trying to predict the best times to buy and sell investments to maximise returns. While it sounds appealing, it carries significant risks. One major risk is unpredictability; financial markets are notoriously difficult to predict, even for experts. Missing even a few of the best trading days can drastically reduce your overall returns.

Market timing can also lead to emotional decisions. For example, investors might panic and sell during a market downturn or impulsively buy during a surge, which can ultimately harm their investment strategy. Furthermore, staying out of the market can mean missing out on potential gains, an opportunity cost that can be substantial given that the market has historically trended upwards over the long term. This makes consistent investment generally more beneficial. Another factor to consider is transaction costs; frequent buying and selling can incur high fees, eating into your returns.

While some studies suggest, that on an index level there is an argument to support this old adage3. Unfortunately, this does not consider all the factors involved. These studies often do not account for things such as the fact that historical trends are not guaranteed, the specific investment style, and the inherent risks of market timing. It is not difficult to find studies and articles that conclude strategic asset allocation is responsible for approximately 90% of returns with tactical asset allocation responsible for around 10%4. While each study may have slightly different percentages, the outcomes are clear that the majority of returns are from strategic asset allocation which is fairly static in nature.

These studies assume that investors remain fully invested in the capital markets over many decades, even during significant events like the failure of Lehman Brothers, the crash of October 1987, the sub-prime mortgage crisis, the dot-com bubble burst, and the 2020 pandemic, among many others that impact the markets5.

At a purely index level, selling in May implies market timing can help an investment portfolio but it does not highlight the dangers of getting it wrong, how easy this is and the actual impact on returns and therefore wealth.

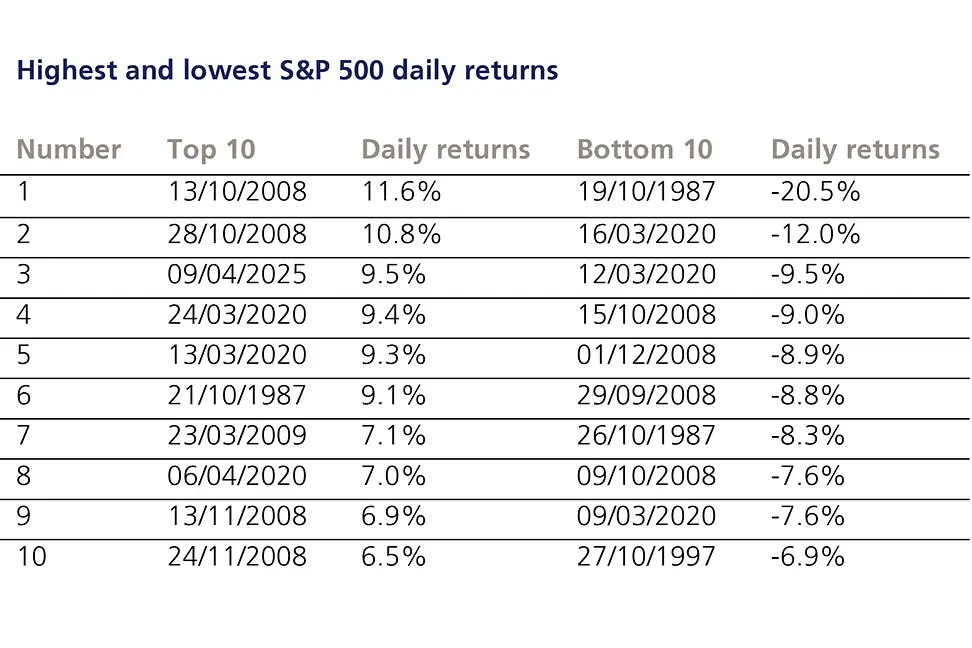

Consider the S&P 500, now trading at historic highs6, and how wide the daily returns can be. This table contains the top 10 and bottom 10 daily S&P 500 returns since January 1950 to April 2025.

Some of the best returns arise during periods of stress as capital markets fluctuate. It takes a brave, or foolhardy, investor to attempt to predict and time these markets.

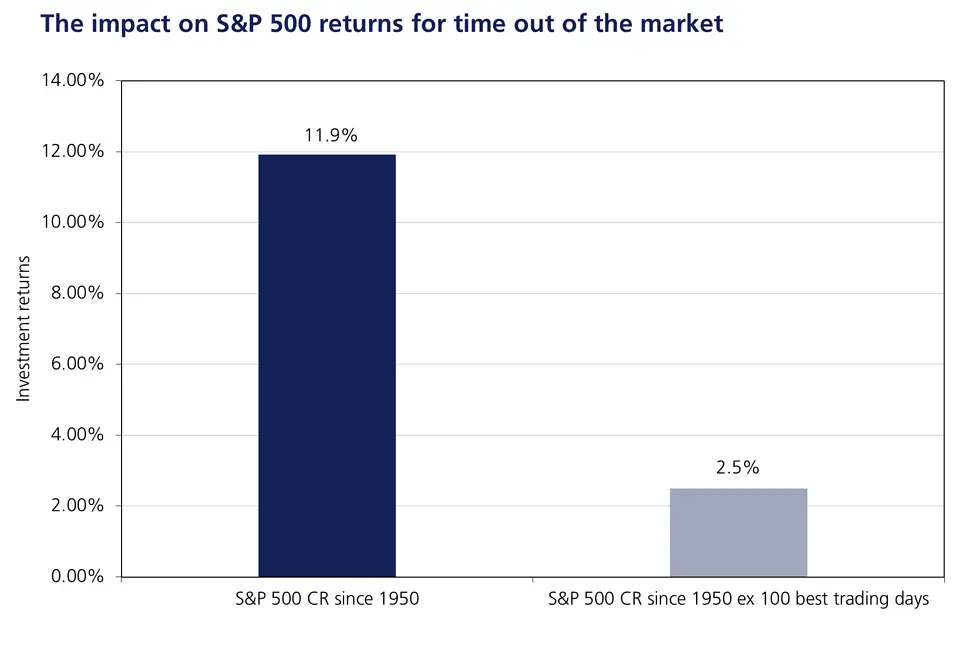

The only true thing that can be controlled regarding market timing, is time in the market not timing the market. What happens if the timing is wrong by just missing the best 100 trading days, or 0.5% of all trading days, between January 1950 to April 2025. That is not a lot, the equivalent of 1.8 days in a year, especially considering an average of 122 days a year are spent asleep. However, it is the impact that matters as shown in the chart below.

The same impact is seen in both the MSCI World and FTSE 100 when the best 100 trading days are missed with the MSCI World seeing a difference of 9.5% versus 0.1% and the FTSE 100 seeing 7.5% for being invested continuously since it was established in 1984 to 2025 and -0.7% for being out of the market for the top 50 trading days7.

Therefore, it is the time in the market and not timing the market, which has a greater benefit to investors who have the risk appetite and tolerance to hold, or even add to, capital markets during periods of uncertainty.

With this in mind, does timing of contributions make a difference to returns? Using the UK Individual Savings Account (“ISA”) and its GBP 20,000 annual allowance, (details on ISAs for US citizens can be found here) consider the return from investing GBP 20,000 each UK tax year in a portfolio that returns 7% per year over a 20 year period.

If we invested at the start of the UK tax year versus investing at the end of the UK tax year, the difference in value is over GBP 57,000 which is nearly three years’ worth of free ISA subscriptions.

There is good reason why Albert Einstein is credited for calling compound interest ‘the eighth wonder of the world’ and adding, ‘he who understands it, earns it; he who doesn't, pays it’.

At LGT Wealth Management US Ltd, we understand US connected families’ needs and requirements in order to establish an approach which allocates their risk across asset classes, jurisdictions and currencies for their investment time horizon. We consider all the risks involved with investing and construct portfolios that incorporate strategies and investments that are resilient, tax efficient from both a UK and US perspective and are designed to mitigate risk to weather market cycles. We aim to ensure our clients’ portfolios remain compliant with both UK and US tax rules, and seek to achieve the goals and requirements of our clients over the long-term.

[1] Bloomberg

[2] Doncaster Racecourse

[3] Stock Trader’s Almanac

[4] The Brinson, Hood, Beebower study of 1986

[5] The Efficient Market Hypothesis and Its Critics by Burton G. Malkiel, Princeton University

[6] Bloomberg

[7] Bloomberg

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.