An Individual Savings Account (“ISA”) is an investment account that allows UK taxpayers to contribute post tax funds on an annual basis (up to £20,000 per annum).

This article has been updated on 17th March 2025.

Restrictions in the amount you can contribute into a UK pension has reduced some high earners options, an ISA can be a very good way of investing in a tax efficient account. The best part is: you do not pay tax on the growth or interest/dividends in your ISA. This means, if you have a cash ISA, all interest earned in the ISA is always tax-free. If you have a stocks and shares ISA, you do not pay tax on any dividends from shares and you do not pay capital gains tax on any profits made from the investments. Additionally (and unlike a pension), an investor will not have to pay income tax on any withdrawals.

Unfortunately, the Internal Revenue Service (“IRS”) consider an ISA as 'look through for US tax purposes'. This means that the investments held within the account will be taxed in the US; effectively eliminating the tax-free benefit and raising the question, ‘Are ISAs worth it?’

In response I would say yes, I believe it is, as the differential in tax rates between the UK and US can still make investing via an ISA for a US taxpayer slightly beneficial compared to investing into an account that is deemed look through for US tax purposes.

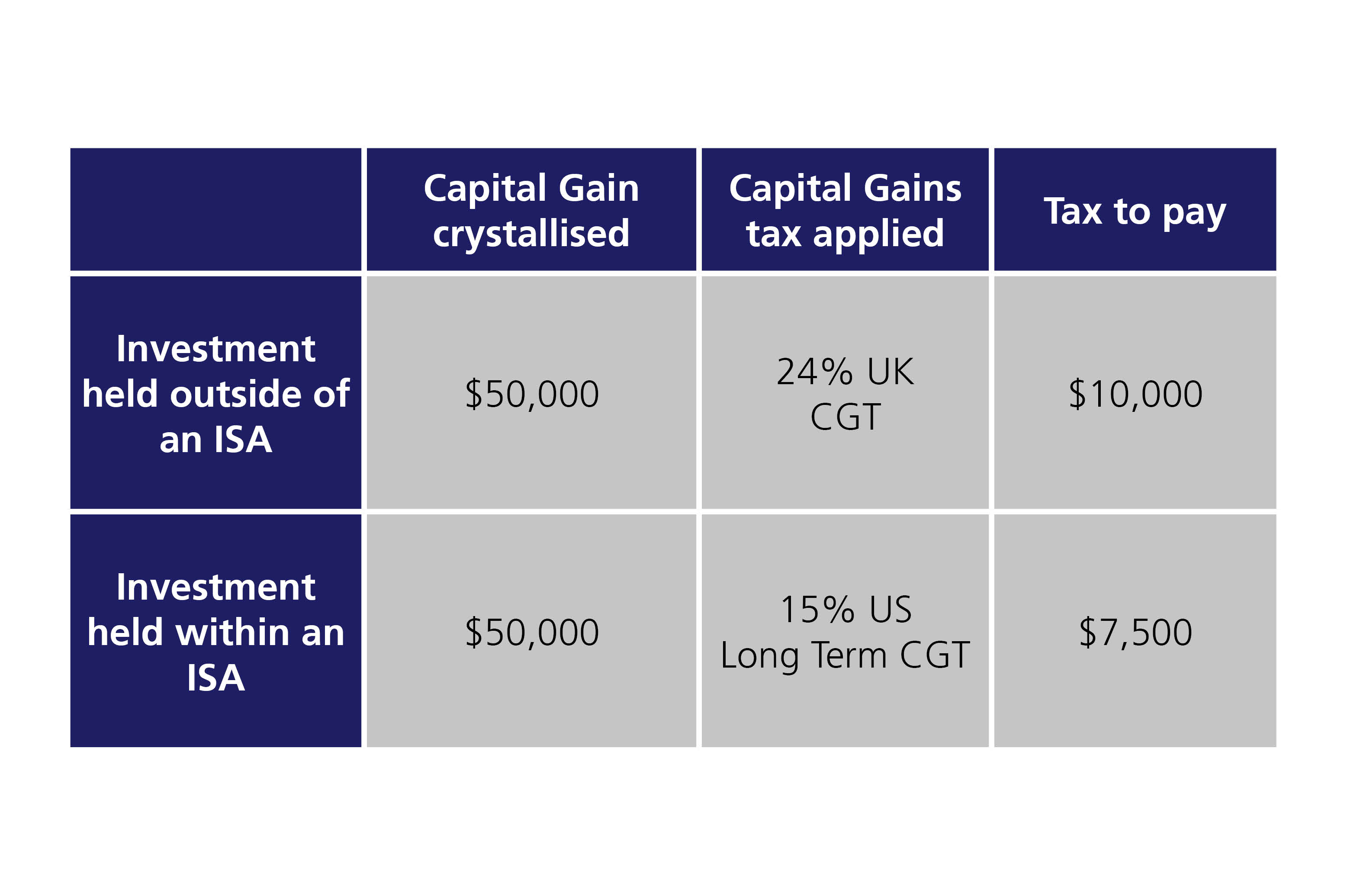

It all comes down to the different tax rates. In the US, most individuals that crystallise a capital gain are taxed to the long-term rate of 15%, whereas a US citizen UK resident that chose to invest outside of an ISA would be taxed to the UK capital gains rate which is currently 24%. Similarly, any dividends or interest payments are taxed to income rates (federal); in the US, this is up to a maximum of 37%, whereas for a similar high earner the UK income tax bracket is 45%.

Although the tax differential is low, when a portfolio grows in size the monetary saving can be significant. An example of the tax differential can be seen below:

A pitfall we often come across is the underlying holdings within an ISA. A typical stocks and shares ISA will most likely be invested in Open Ended Investment Company's (“OEICs”), investment trusts, or exchange-traded funds. These investments will still be deemed Passive Foreign Investment Companies (“PFIC's”) even though they are held within an ISA and the dreaded PFIC rules will apply.

Providing your ISA is invested correctly and the investments are taxed to "qualifying rates" then an ISA is a good way to reduce your tax burden.

You must however take care in ensuring that any ISA is included on your Foreign Bank Account Report (“FBAR (“).

Here are a few additional points to consider to make the most of your ISA allowance, now and in the future:

This document has been prepared by LGT Wealth Management US Limited for information purposes only and does not constitute investment, tax or any other type of advice and should not be construed as such. The views expressed herein do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. All investments involve risk and may lose value. Your capital is always at risk. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future. LGT Wealth Management US Limited is Authorised and Regulated by the Financial Conduct Authority in the United Kingdom, and is a Registered Investment Adviser with the Securities & Exchange Commission in the United States.