As long-term stewards of our clients’ capital, we believe achieving strong, long-term financial returns includes actively engaging with the companies we invest in, ensuring they are forward-looking and well-positioned to manage risks and opportunities in an ever-changing world. Proxy voting is a vital tool as it enables us to engage constructively with boards, voice shareholder concerns and promote better practices that could contribute to long-term value for our clients and society as a whole.

As equity shareholders in the publicly listed companies in which we invest, we have the opportunity to vote at shareholder meetings. Proxy voting allows shareholders like us to formally express views on corporate decisions. These votes cover a wide range of topics, from approving financial statements and electing Board members to setting executive pay, shaping governance practices, or addressing environmental and social risks. While most topics which are presented as resolutions are submitted by management, shareholders can also file proposals.

We vote on all directly held equities in companies on our approved buy list across discretionary client portfolios, guided by our Global Voting Principles, which focus on material ESG risks and long-term value creation. While we also consider input from a proxy advisor, each vote is assessed individually to reflect company-specific context. To enhance transparency, we also publicly disclose our historical voting instructions.

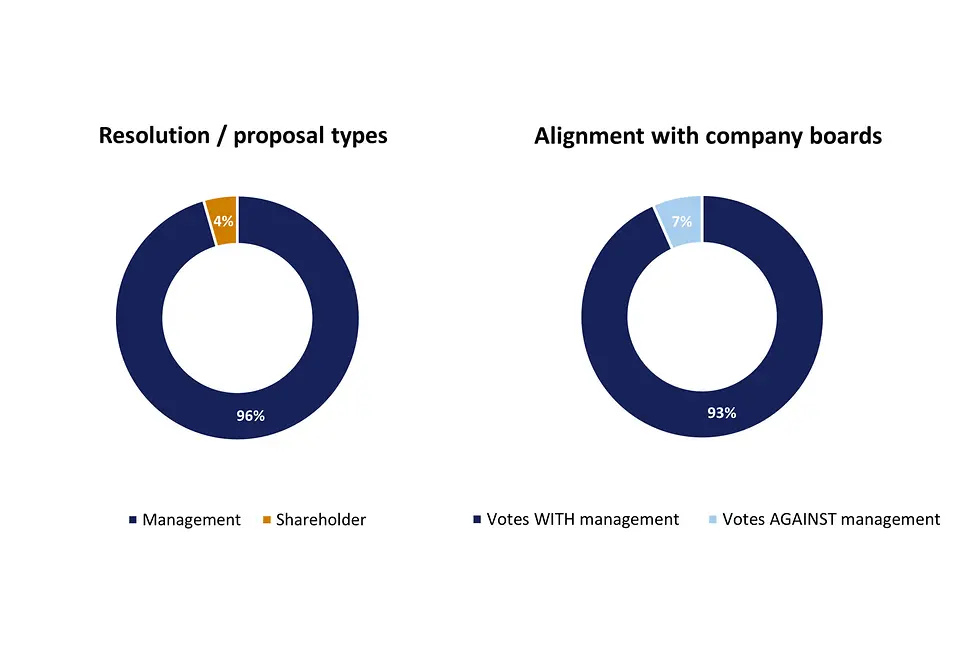

In 2024, we voted on more than 3,000 resolutions across 201 shareholder meetings and 180 companies. Most proposals (96%) were submitted by management, primarily focusing on Board structure, governance, capitalisation and executive compensation. Shareholder proposals (4%) covered issues such as hiring practices, human rights, environmental impact and political spending. We supported 62% of shareholder proposals that we deemed reasonable, addressed material risks and posed no unintended costs to the company.

We supported management recommendations in 93% of votes. The remaining 7% (201 votes) were situations where we chose to vote against management recommendations, primarily over concerns with board leadership, potential conflicts of interest or strategic decisions. We also opposed some executive pay proposals where there was a lack of clear performance targets, inadequate climate transition plans, limited diversity reporting or shortcomings in labour practices.

Our most significant votes in 2024 were shaped by clear thematic priorities like climate, fairer societies, AI and political lobbying and transparency.

Climate and environmental responsibility remained key priorities for our voting. At Microsoft, we supported a shareholder resolution requesting the company disclose how its AI and machine learning tools are used by oil and gas firms to aid fossil fuel exploration by identifying optimal drilling locations. This practice runs counter to Microsoft’s public climate commitments and presents reputational and strategic risks. Similarly, at Amazon, we backed a proposal calling for greater transparency around the company’s plastic usage and efforts to reduce it across its supply chain with clear reduction targets. Both proposals were ultimately not approved but received meaningful levels of support (10% 1and 28% 2), signalling investor concern about environmental performance.

Beyond the environment, we also prioritised issues related to work and fair labour practices. At Amazon, we voted in favour of an independent audit into warehouse working conditions driven by ongoing concerns around injury rates and performance pressure. The proposal received 31% support 2 and remains an area where we continue to engage the company.

The ethical use of emerging technologies, particularly AI, was another growing area of concern for us. At Microsoft, we supported a proposal for an independent assessment of the company’s role in military weapons development, including its work on the HoloLens for the US Army. We also backed a proposal urging the company to disclose how it sources third-party data for training its AI models. The latter received 36% support 1 – a strong signal for greater ethical oversight in AI development.

Corporate transparency and accountability continued to be a focus too. At Eli Lilly, the US pharmaceutical company that produce drugs such as Zepbound and Mounjaro, we voted for enhanced lobbying disclosures to ensure alignment between public commitments (e.g. on drug affordability) and lobbying activities. With 25% support 3, the proposal pointed to growing investor concern over misalignment between public commitments and behind-the-scenes advocacy. Lastly, at Alphabet, the parent company of Google and YouTube, we supported a resolution calling for clearer performance metrics and targets to evaluate child safety on YouTube. Despite low shareholder support (14% 4), we believe the proposal raises urgent issues around platform accountability and regulation.

In 2024, our votes reflected a deliberate focus on environmental stewardship, human capital, technological responsibility, and corporate ethics. We remain committed to using our voice to drive change constructively and transparently.

To learn more please see our latest Stewardship Report, which includes case studies and outcomes from our engagement activity.

[1] Microsoft: https://www.microsoft.com/en-us/investor/corporate-governance/votingresults

[2] Amazon: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001018724/069df373-8bf7-45d8-adf9-769a48cebbff.pdf

[3] Eli Lilly: https://investor.lilly.com/static-files/f1918c6c-7249-4c3b-bba4-b03b101b404e

[4] Alphabet: https://abc.xyz/assets/bb/9e/6edb74c225a65859e42261ae4b11/4d03d29b576032a603b6e429d17f8f1a.pdf

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.