Most people have heard of green bonds, which allow governments and companies to raise money for projects that are good for the environment, such as building solar power plants, improving energy efficiency, and cleaning up pollution. Far fewer, however, have heard of blue bonds—a newer type of bond designed to protect oceans and water resources. But with the Thames Tideway Tunnel’s successful issuance of a blue bond in June—a £250 million offering and the first of its kind in the UK1—the tides may be turning for this innovative financing tool.

This week, we explore what blue bonds are, their unique features, why they appeal to sustainability-focused investors and how they are being used to fund London’s sewage infrastructure.

A blue bond is a type of debt instrument specifically designed to raise capital for projects that support the sustainable use, conservation, and restoration of ocean and freshwater resources. Typical projects include building sustainable fisheries, restoring marine ecosystems, reducing pollution, and improving clean water and sanitation infrastructure. Blue bonds are also used to fund coastal climate adaptation—such as building sea walls, restoring wetlands, or implementing sustainable urban planning to address rising sea levels and stronger storms—and to create sustainable marine value chains in industries like fishing, seafood processing, and shipping.

Like conventional bonds, blue bonds are issued by national governments, development banks, corporations, or municipalities, and investors receive regular interest payments and the return of principal at maturity. In many cases, blue bonds are repaid exclusively through the proceeds generated by the funded projects, without relying on other revenue streams.

Blue bonds can be considered a sub-category of green or ESG (environmental, social and governance) bonds and are built upon established sustainable finance frameworks, particularly the Green Bond Principles. These voluntary guidelines, published by the International Capital Market Association, promote transparency and integrity in the green bond market. To qualify as a “blue” bond, projects must align with these principals, and all proceeds must be dedicated to advancing Sustainable Development Goals (SDGs). Adopted by the United Nations in 2015, the SDGs are a set of 17 global objectives addressing economic, social, and environmental challenges. Projects funded by blue bonds are expected to contribute to SDG 6 (clean water and sanitation) and/or SDG 14 (life below water).2

The first blue bond was issued by the Republic of Seychelles in 2018 to support sustainable marine projects,3 marking the start of this financing mechanism. While sovereign states and development banks initially lead issuance, corporate issuers entered the market in 2020, and are now the largest issuer of blue bonds, reflecting growing interest and demand for sustainable marine finance.

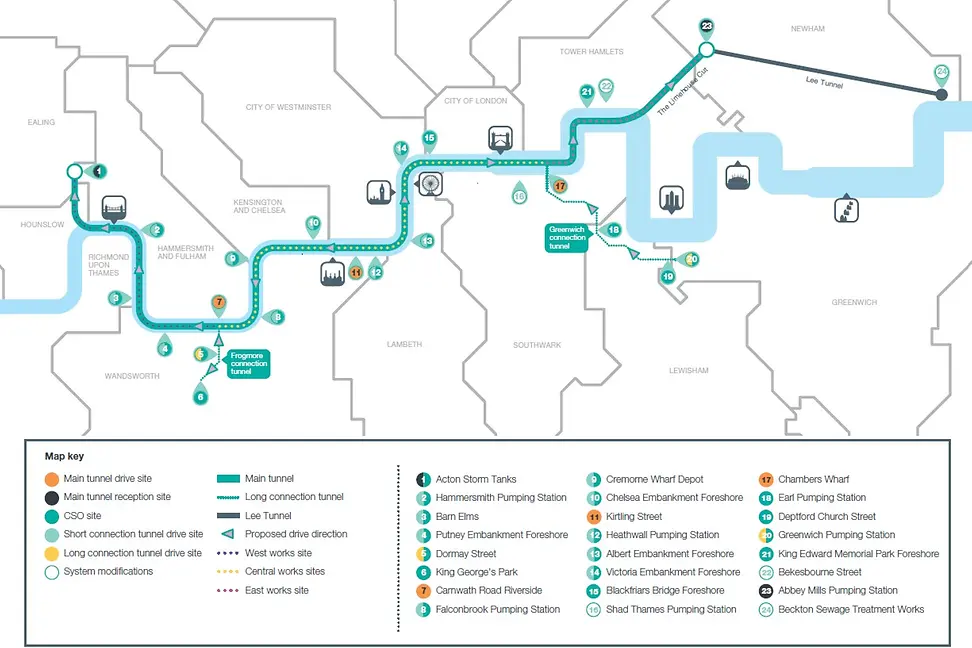

The Thames Tideway Tunnel (Tideway), often called London’s “super sewer,” is a 25 km deep-level sewer running from Acton in west London to Abbey Mills in Stratford, east London. It connects with the existing 6.9 km Lee Tunnel to form the London Tideway Tunnel system. Designed to intercept and store most of the raw sewage and rainwater from combined sewers that would otherwise overflow into the River Thames during heavy rainfall, this tunnel addresses the chronic problem of sewage pollution caused by the city’s overstretched Victorian sewer network. By capturing wastewater from 34 of the most polluting combined sewer overflows, the project aims to reduce sewage spills into the Thames by about 95%.

Following initial commissioning and completion of construction, the Thames Tideway Tunnel is now in its system acceptance and testing phase. This phase involves rigorous real-world testing of the tunnel and its infrastructure, including the interception and conveyance of sewage and stormwater during actual rainfall events. The system acceptance period, expected to last up to 36 months, ensures the tunnel meets all regulatory, environmental, and operational standards. During this time, performance will be closely monitored, fine-tuned and independently verified before being fully handed over to Thames Water in August 2027. Once operational, Tideway will retain full ownership of the deep tunnel structure, while Thames Water will be responsible for the day-to-day operations and maintenance of the tunnel system as part of London’s wastewater infrastructure.

In June 2025, Tideway became the first UK corporate to issue a sterling-denominated blue bond, raising £250 million through an 8-year note maturing in 2033. The bond, which is rated Baa1 by Moody’s and pays a 5.5% coupon, received strong demand upon issuance and continues to trade actively in the secondary market.

Unlike Tideway’s previous green bonds, which funded the construction of the Thames Tideway Tunnel, this blue bond is specifically dedicated to benefiting water environments. The proceeds will be allocated to pollution prevention and sustainable water management, in line with international sustainable finance standards. This includes furthering the tunnel’s mission to prevent sewage pollution and improve the health of the River Thames during the system acceptance phase. The bond is subject to transparent reporting and independent verification to ensure accountability and alignment with sustainability goals.

This landmark issuance underscores Tideway’s leadership in sustainable finance and sets a precedent for the UK’s blue economy. It also opens the door to further blue bond issuance by other UK corporates, particularly water utilities, which have expressed interest using this instrument to attract a broader pool of sustainability-focused investors. Historically, such investors have had limited options for sustainable investing in the sterling bond market.

This growing interest in blue bonds comes at a critical time. UK water utilities face substantial capital expenditure obligations over the coming decade to address ageing infrastructure. Ofwat, the water regulator for England and Wales, has mandated an unprecedented £104 billion in total investment for water utilities in England and Wales until 2030,4 more than a two-fold increase from the last regulatory period. Investment in new infrastructure will quadruple to £44 billion.

Given the scale of these capital requirements, investors anticipate a substantial rise in bond issuance by water utilities in sterling as well as other currencies. Blue bonds in particular may be a compelling option for investors, especially those less familiar with the specific dynamics of the UK water sector.

Blue bonds present a compelling opportunity for investors seeking to make meaningful progress while earning sustainable returns. These notes are particularly impactful in areas such as combating water pollution, supporting marine protected areas and advancing coastal resilience projects. By providing a clear link between investment and measurable environmental outcomes, blue bonds appeal to a growing market of sustainability-conscious investors.

Structured with transparency and accountability in mind, they enable investors to track the positive impact their capital is delivering. Thames Tideway Tunnel’s blue bonds are a prime example how this funding mechanism directly supports clean water and sanitation goals in the London area. As the first public blue bond offering in the UK, it sets a benchmark for future issuances and highlights how sustainable finance can address critical environmental challenges.

Ultimately, blue bonds allow investors to align their portfolios with global sustainability goals, contributing to long-term improvements in public health and resilience of marine ecosystems. For those considering incorporating blue or green bonds in their fixed income portfolios, our advisors are available to help you explore these opportunities and align your investments with your values.

[1] Tideway London: https://www.tideway.london/news/press-releases/2025/june/super-sewer-project-becomes-first-uk-company-to-issue-blue-bonds/#sub-nav

[2] Sustainable Development Goals: https://sdgs.un.org/goals

[3] World Bank: https://www.worldbank.org/en/news/press-release/2018/10/29/seychelles-launches-worlds-first-sovereign-blue-bond

[4] Ofwat: Our final determinations for the 2024 price review – Sector summary

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.