With the Lionesses keeping England fans on their toes and narrowly defeating the Italian side on Tuesday evening, England are just one step away from becoming back-to-back European champions, with only Spain standing in their way of lifting the trophy on Sunday night. But where do women’s elite sports sit in terms of their market value? The meteoric growth of women’s sports could offer brands and investors the opportunity to reach new audiences, access new revenue streams and secure high returns.1 Certain investors, brands and nations are seizing the opportunity, predicting that elite women’s sports could be the next ‘big thing’.

On Boxing Day of 1920, 53,000 spectators turned out at Goodison Park to watch the Dick, Kerr Ladies – a munitions factory team from Preston - face St Helens in a charity game raising money for wounded soldiers. During wartime, it was commonplace for women to play football, for morale and to raise money for charities. The attendance of this particularly historic match was almost double that of a men’s Premier League fixture at the time.2 Just one year later, the FA voted to ban women’s football.

“The game of football is quite unsuitable for females and should not be encouraged.”

- FA’s Consultative Committee, 5 December 1921.

This ban lasted a staggering 51 years3 and its effects on the game continue to be felt. Women’s football has only recently seen a boost in popularity thanks to the Lionesses’ recent successes – with the trophy ‘coming home’ in 2022, a feat which has evaded the men’s England squad for almost 60 years. However, women’s sport still falls short to the men’s equivalent in terms of sponsorships, broadcast coverage and overall investment.

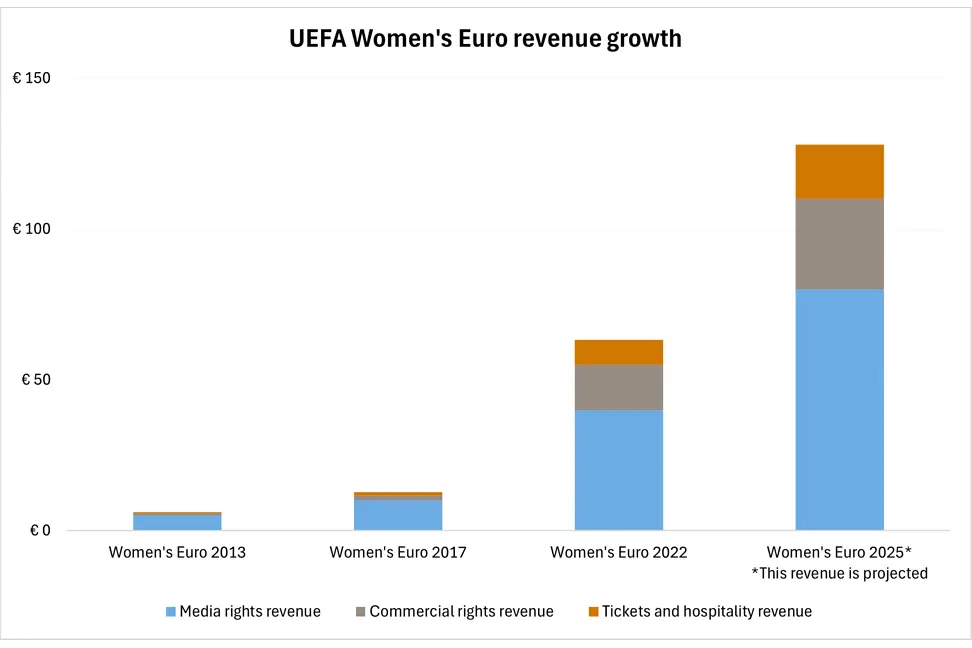

Fast-forward to July 2025 and the same game is a commercial juggernaut. Switzerland’s month-long UEFA Women’s EURO has shifted more than 600,000 tickets; the group stage alone drew 461,582 fans - an average of 19,232 per match - with Basel’s Germany-Denmark clash attracting a record 34,165.4 UEFA anticipates total revenues for this year’s tournament of EUR 128m, double the amount generated by Euro 2022 and 32 times more than the EUR 3.9m delivered by the eight-team 2005 edition just 20 years ago.5 The majority of this income is expected to come from media and commercial rights, along with ticket sales and hospitality.

Momentum is fierce and the trajectory looks set to continue in this way.

This is attractive for future host nations of tournaments like the Euros. UEFA predicts that the 2025 Euros could generate as much as CHF 193 million for the Swiss hosts, a huge boost to the local economy, driven mainly by travelling fans keen to catch a glimpse of their own nation on the world stage.

It is predicted that global revenues in women’s elite sports will reach approximately £1.88 billion in 2025, rising by 240 per cent in just four years. So what’s behind this growth? 54% is set to be supplied by commercial income, assets like sponsorship, merchandising, tours, the remainder of the mix is rounded out by broadcast and match-day content. The real challenge for the industry is looking beyond short-term metrics and truly seeing the long-term investment in the industry, building legacy programmes, getting brands to do things differently and create an ecosystem where women’s sports can truly thrive.6

England’s stunning victory at the 2022 Euros triggered a wave of momentum across the UK’s women’s sports landscape and beyond - from participation and attendance, to media, investment and grassroots opportunities. Media rights for women’s football surged by 289% compared to the previous Women’s Euros.7 WSL match attendance increased by 227% in 2022 compared to 2021, and Bundesliga saw a 277% rise in Germany.8 Women’s sport is booming outside of football too, with Women’s rugby attendance increasing by 69% from 2019 to 2023 and rugby’s 2025 World Cup aiming to deliver another “generational moment”.9

And demand is ever increasing. Nielsen Fan Insights reported that nearly a quarter of the US population said there isn’t enough information in the media to keep up with women’s sports10, proving the need for continued investment to keep up with this demand. Whoopi Goldberg is a pioneer in this field of broadcast, launching the All Women's Sports Network attempting to rectify the imbalance of sport representation by being the only network dedicated exclusively to women’s sports.

Ex-England men’s legend and pundit Ian Wright is a passionate supporter too. His advocacy for the game as well as personal financial investment demonstrates his genuine passion for the sport. Wright donated £15,000 to a fund which helped train over 600 new female coaches. When Stoke City’s Kayleigh McDonald ruptured her ACL and the club refused to cover her rehabilitation costs, Wright funded her treatment and hired a lawyer to fight her case.11 The Arsenal legend has helped shape a more inclusive footballing landscape and has consistently demonstrated his solidarity with women in his beloved sport.

The National Women’s Soccer League (NWSL) in the US is seeing the demand from investors to expand at an encouraging pace. Many of the board members on the NWSL see the league doubling in size from 16 to 32 teams, matching the franchise size of the National Football League (NFL). It took the men’s equivalent 16 years to double its size, but with the appetite for investment in the women’s game, perhaps the trajectory could be faster? Denver is the latest addition to the NWSL, securing its place in the league, paying a record-breaking expansion fee of $110 million and it’s expected to build out its commercial entities in the form of a state-of-the-art stadium and facilities for their players and staff.12

In the Women’s Super League, early-stage valuations remain modest relative to men’s assets, which is precisely why tech investor Alexis Ohanian (the founder of Reddit) moved quickly when Chelsea spun out its women’s team as a standalone entity. His £20 million for 10% implies a £200 million club valuation, which is roughly the same multiple of revenue applied to many Premier-League men’s sides a decade ago. Ohanian predicts the side will top £1 billion by 2035, citing untapped US broadcast upside and proven merchandise demand.13

From Goodison Park in 1920 to billion-pound valuations in 2035, the women’s game is no longer in the background, it’s becoming part of mainstream sports investment strategies. For the broader sports world’s business landscape, the real opportunity lies in patient capital, aligning with ESG values and scalable growth curves rarely seen in mature men’s leagues. The trajectory is clear: women’s sport isn’t just catching up; it’s rewriting the playbook.

We welcome the advancements in developing women’s elite sports, as we move towards greater equality in the industry as well as greater development and resources for young women in the UK and beyond. We’ll be tuning in on Sunday - see you at kick-off!

To learn more about #Included visit our Diversity and Inclusion page.

[2] https://www.worldfootball.net/attendance/eng-premier-league-1920-1921/1/#google_vignette

[3] The Guardian: https://www.theguardian.com/football/2022/jun/13/how-the-fa-banned-womens-football-in-1921-and-tried-to-justify-it

[4] ESPN: https://www.espn.com/soccer/story/_/id/45740457/euro-2025-attendance-record-broken-group-stage

[5] Sportspro: https://www.sportspro.com/insights/analysis/euro-2025-commercial-preview-switzerland-ticket-sales-revenue-uefa-two-circles/

[7] https://www.englandfootball.com/articles/2022/Oct/04/EURO-2022-flash-impact-report?

[8] https://sportfive.co.uk/beyond-the-match/insights/the-rise-of-women-s-football-in-germany

[9] https://www.ft.com/content/776e35e1-1a96-40cc-bdd4-d2db57da1958?

[10] Nielson: https://www.nielsen.com/insights/2023/womens-sports-viewership-on-the-rise/

[11] Palatinate: https://www.palatinate.org.uk/not-blocking-but-building-ian-wrights-role-in-womens-football/

[12] New York Times: https://www.nytimes.com/athletic/6034199/2025/01/02/nwsl-expansion-denver-record-price/

[13] ESPN: https://www.espn.com/soccer/story/_/id/45148351/reddit-ohanian-buys-stake-chelsea-women

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.