To say 2024 was all about the Magnificent 7 may seem like an exaggeration, but it is hard to overstate the impact these companies had on equity market returns last year. Microsoft, Apple, Alphabet, Amazon, Meta, Nvidia and Tesla, some of the largest in the US and the world, collectively accounted for 54% of the S&P 500’s gains last year.

With such outsized influence on equity markets over the past couple of years, the question now is whether these companies can maintain their momentum. While the past is not a guide to future performance, were there any hints in the first quarter earnings as to what the future holds for the Mag 7?

Firstly, the caveats. Caveat number one is that Tesla shouldn’t really be on the list at all as it’s a car manufacturer. Yes, it is magic that it created demand for electric cars from scratch. However, much as its CEO talks up the technology, all the key measures of its profitability are those of a car maker rather than a tech company (and a Toyota/VW rather than a Ferrari at that).

Tesla’s real magic is the difference between the market capitalisation of the company and its value as a car maker – all of which comes down to the hope and expectation that its CEO’s talk of robotaxis and humanoid robots comes to pass. Quarterly earnings were a more of a comedown. Tesla sales have fallen almost 20% over the past two years and peak production was more than a year ago. Cutthroat competition means that all the positives that came from a 7% decline in making each car were more than wiped out by a 12% decline in revenue per car. If Tesla hadn’t made a lot of money selling carbon credits to other automakers that aren’t as advanced in electric vehicles, it would have made a financial loss. Musk’s so-called magic dust cannot come soon enough.

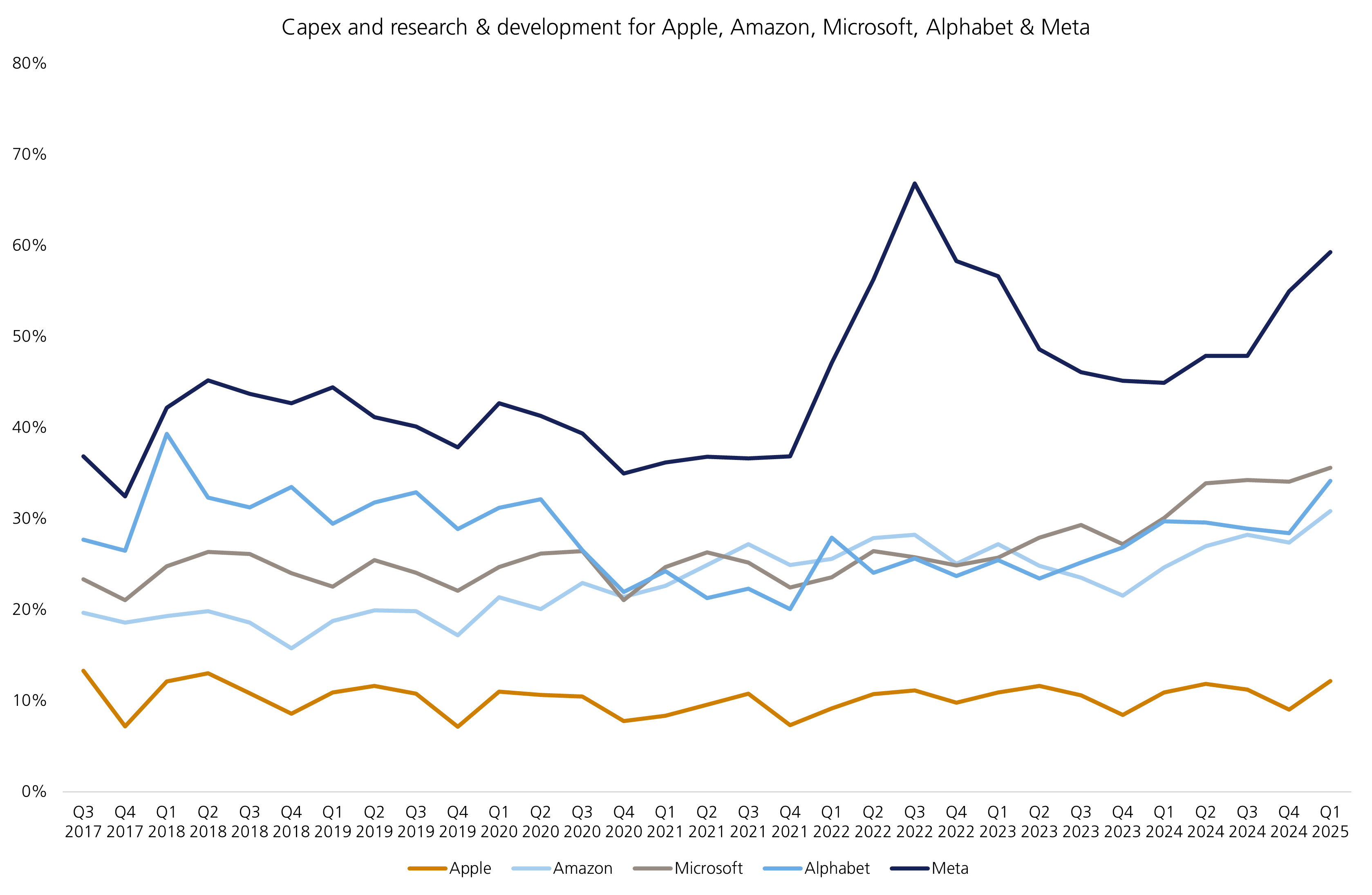

The second caveat is that Nvidia’s financial year runs to January so its Q1 earnings aren’t for a couple of weeks. However, four of the Mag 7’s earnings (Microsoft, Alphabet, Amazon and Meta) imply that demand for Nvidia’s AI chips remains robust. This is crucial given Nvidia’s top three customers accounted for over a third of their total sales last year. Between them, the four companies spent $72 billion in the quarter on capital expenditure, a lot of which went to Nvidia for their AI chips. They also spent $57 billion on research & development (R&D). Big numbers. But these are the world’s largest companies so where’s the context? These four companies spent 36%, 34%, 31% and 59% respectively of their quarterly revenue on capex and R&D and there’s no sign they’re going to stop. Also important to remember these are software companies that don’t require huge production lines to manufacture cutting-edge widgets.

We’ve been waiting to see if AI appears in the revenue line of any of these companies, either as a positive or a negative (from ChatGPT and other AI competition). Meta is the only one where that eye-watering spending on AI appears to be paying off. Management said AI has increased user engagement, time spent on Facebook and Instagram and conversion rates. Which is perhaps why the price per ad, which declined in 2023, rose all through 2024 and grew 14% in Q1 2025. This is great for Meta, but needs to continue given that money going out the door in capex and R&D.

Over at Alphabet, it’s hard to discern any additional revenue from all that AI investment even though 12% revenue growth in Q1 2025 is not to be sniffed at, given revenue was $90 billion. We are pleased to see no negative impact from the rise of ChatGPT and other chatbots. That was, until an Apple executive said in a Federal Court (Google or ChatGPT as to why) that in April 2025, search through their Safari browser (which only uses Google) fell for the first time ever. He speculated this was down to competition from AI-powered alternatives. Google responded that search queries continue to grow, including from Apple devices, though didn’t clarify the Safari point. What we do know is that paid clicks on Google (basically volume) increased only 2% in Q1 versus 7% a year ago and double digits back in 2021 and 2022, so demand is definitely slowing. Thankfully, Google Search is only just over half of Alphabet’s sales nowadays, with YouTube, Cloud and subscriptions making up the rest. Google does of course have its own Gemini AI, but could Google’s days of dominating search be numbered?

Microsoft’s AI spending is mostly around its massive cloud business, which has defied the law of very large numbers and has seen revenue growth accelerate from 15% at the end of 2023 to around 20% for the last seven quarters. That spending, however, meant that Cloud profitability in the latest quarter was the lowest for nine quarters.

Amazon seems determined to win the ‘biggest spender on AI’ trophy with its $25 billion in Q1 capex, making Meta’s $17 billion look comparatively puny. Not unlike Microsoft, Amazon’s even bigger AWS cloud division has seen revenue growth reaccelerate from the 12-15% range in 2023 to 17-19% over the past year with management suggesting that modernising infrastructure and AI are helping drive this. Amazon’s $58 billion advertising business should also be a beneficiary of AI but decelerating growth suggests this has not happened yet.

And what about Apple, the company formerly known as the world’s largest company? (See Microsoft and Nvidia for details). Remember, it’s designed in California and made in China (or India sooner rather than later) so they spend vastly less on capex and R&D. They appear to be taking their time, letting the big boys nuke it out while they pick and choose whose AI to use on their devices. While revenue has gone from negative growth in 2023 to 5% in each of the past four quarters, it’s not clear whether the limited AI capabilities of the iPhone 16 has driven this.

In summary, it’s not the Mag 7, but the Mag 6 + Tesla, and while there are some tentative signs that AI is improving revenue growth, it’s not clear whether this is a good return on their huge AI investment.

What is clear is that AI capex is showing no signs of stopping.

This makes the companies riskier than before ChatGPT. And Alphabet needs to be shouting from the rooftop for users to stick with their AI search and not succumb to ChatGPT’s charms.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.