Following on from the article “State Pension: what are the changes to know?” this article aims to summarise both the UK State Pension and US social security benefits and also looks at the impact of the Windfall Elimination Provision (WEP) if you are entitled to benefits from both sides of the Atlantic.

This article has been updated on 17th April 2025.

To be eligible for the New State Pension in the UK, an individual needs to have a minimum of 10 qualifying years. Individuals with at least 35 years will be entitled to the full basic New State pension.

It is possible to top up your National Insurance (NI) record to purchase additional qualifying years for the UK State Pension, and this is outlined in the previous article referred to above.

Currently the age at which you can start to draw a state pension in the UK is 66, however, the age is gradually increasing from 6 May 2026 and will be age 67 by 2029. Please note that the State Pension age is going to be kept under review, which means it could adjust again in the future depending on various factors such as changes in life expectancy. As of the 2025/26 tax year the maximum annual benefit amounts to £11,960 or £230 per week.

If you have a UK Government Gateway ID, you can easily check your state pension record here.

To be eligible for Social Security, an individual must contribute to the system by paying the Old-Age, Survivors and Disability Insurance program (“OASDI”) tax on earned income. An individual receives one credit for each $1,810 (2025) in net earnings during the year and can earn a maximum of 4 credits per year. After attaining a minimum of 40 credits, you will qualify for a social security benefit as well as access to premium-free Medicare Part A (hospital insurance) for you and your spouse. This ultimately equals a minimum of 10 years of eligible credits.

Benefits are calculated using average indexed monthly earnings. The average includes 35 years of an individual’s highest earnings and if you have less than 35 years in US earnings, the excess years get marked at zero, decreasing your average. The maximum annual benefit in 2025 at full retirement age is $48,216 per year or $4,018 per month. By setting up an account on the social security website, you can view your projected benefits and contribution history (please note you will require a US mobile phone number and US social security number to do this).

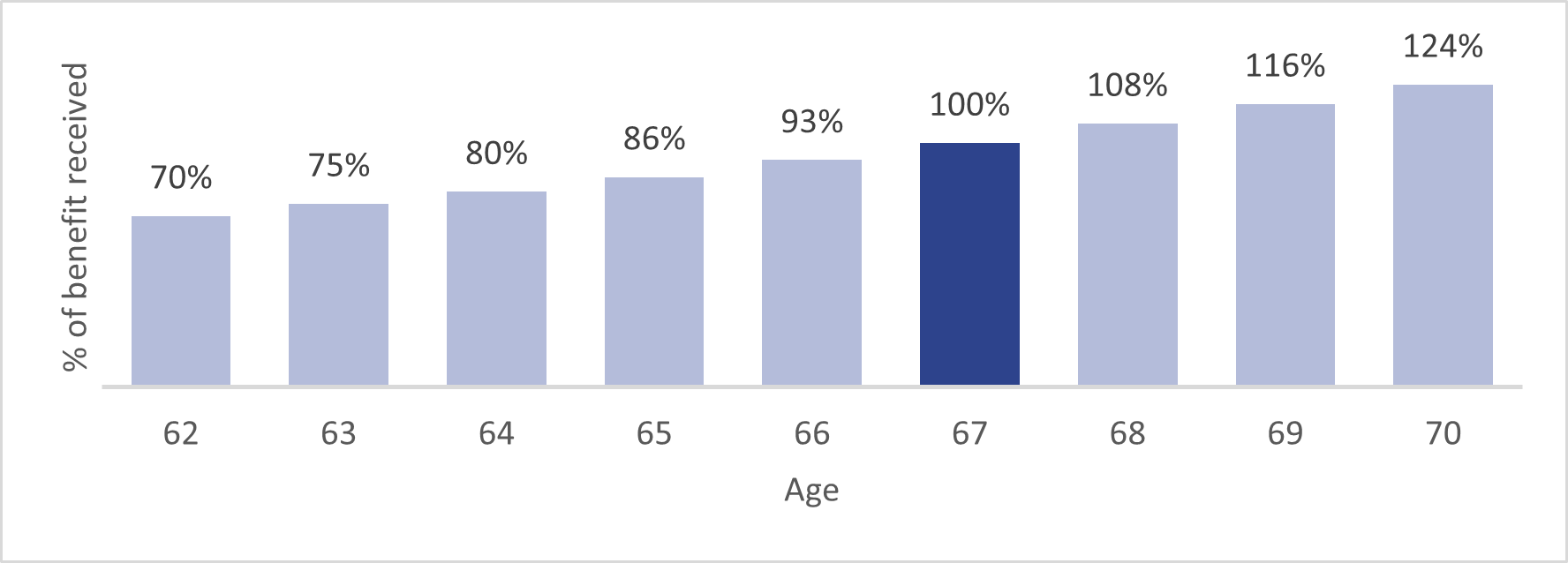

Currently, the full retirement age (“FRA”) is 67 for people born 1960 and later. However, you are first entitled to start drawing benefits as early as age 62 and can delay your pension as late as age 70. The timing of beginning your retirement benefits is important as the longer you delay, the larger the monthly benefit. By starting social security before full retirement age, your benefits will be permanently reduced. Please see the chart below illustrating the impacts of collecting your pension early versus delaying with an FRA of age 67.

The US and UK have an agreement in place to provide additional credits to reach qualification of benefits in their respective countries. This would apply to individuals who spent part of their careers in the US and UK and require gap-fill to reach the minimum requirements of 10 years. Thus, allowing these individuals to still obtain a benefit due to this agreement between the two nations. In this case, the US and UK benefits will each pay out pro-rata based on the time spent working (accruing credits) in each jurisdiction.

If, over the course of your career, you have sufficient credits in each jurisdiction to be entitled to both US social security as well as the UK State Pension, then the windfall elimination provision or “WEP” may have had an impact on the level of benefits you have received from your US Social Security.

On 5 January 2025, President Biden signed into law the Social Security Fairness Act which ended WEP with effect from January 2024.

As the law is retroactive, the law requires the US Social Security Administration (SSA) to adjust people’s past benefits as well as future benefits. Processing these changes is very complex and much of the work will need to be done manually and on a case by case basis. They will focus on processing pending or new claims for Social Security benefits and are developing procedures and automated solutions for computing retroactive benefits. It will, however, take the SSA some time to implement these changes and it will likely take more than a year for the adjustments to be made. (Whilst also assuming this order is not reversed by the new administration.)

Due to these changes, it is important that the mailing address and/or direct deposit information that the SSA has on file is accurate so they can adjust benefits as quickly as possible. The easiest way to ensure your information is correct is via your my social security account.

We would also suggest that you do speak with your regulated financial adviser or tax adviser before making any big financial decisions.

LGT Wealth Management US Limited is a registered Company in England & Wales, registered number 06455240. Registered Office: 14 Cornhill, London EC3V 3NR. LGT Wealth Management US Limited is Authorised and Regulated by the UK Financial Conduct Authority and is a Registered Investment Adviser with the US Securities and Exchange Commission.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.