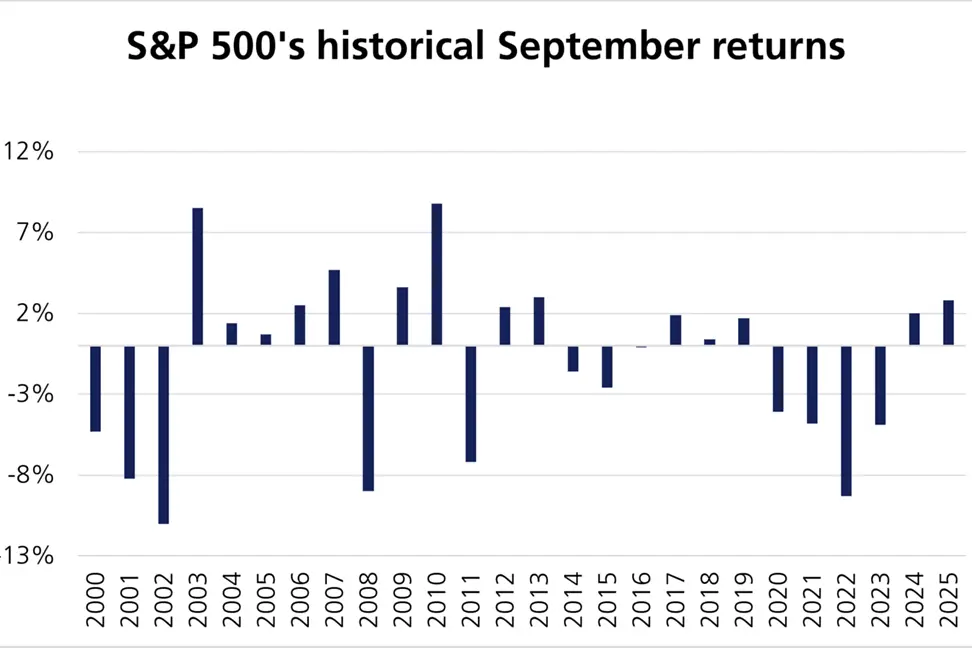

September has a reputation for being a challenging market for global stock markets. Going back nearly a century, equities tend to underperform in September more compared to any other month.1

This year has seen plenty of ups and downs, including tariff-related turbulence, followed by a strong rally in global equity markets. The S&P 500 rose 10.8% through the end of August while the MSCI World rose 5.5% in pound terms. Given September’s reputation, many expected a reversal, but this year, equities bucked the trend, with the S&P 500 rising 2.3% and the MSCI World up 3.1% in sterling terms through 25 September.

There are several reasons why September has historically been a difficult month for equities. One is seasonality. There is the longstanding theory that investors return to work from the summer holidays and rebalance their portfolios or take profits, which results in selling pressure. Tax and fiscal year dynamics have also played a role. In some jurisdictions, mutual funds and institutions may sell holdings before fiscal year-ends – for example, the tax year ends in September for mutual funds in the US – contributing to downward pressure. There is also a belief that individual investors liquidate stocks going into September to offset school fees.

Now, most economists believe the so-called September Effect has faded. Market participants are aware of it and may adjust their behaviour accordingly, such as selling in August instead. Notably, major September selloffs have become rarer since the 1990s.2

The 2.3% jump in the S&P 500’s performance this September can be partly attributed to expectations ahead of the Federal Reserve (Fed) most recent rate cut and the belief that it will lower rates further in 2025. Interest rate cuts benefit equities for several reasons:

While historical trends like the “September Effect” can influence short-term sentiment, they are only one piece of a much larger puzzle. Economic fundamentals, monetary policy decisions, and investor psychology all drive equity performance. Markets are forward-looking. When investors anticipate a shift in central bank policy, such as cutting interest rates, they often react in advance. This is evident as major market moves are often driven more by expectations. This brings to mind the old phrase “buy the rumour, sell the fact.”

Seasonal patterns and historical averages provide helpful context, but making investment decisions based purely on the time of year can lead to undesirable outcomes. Underlying economic trends, fiscal and monetary policy direction, and individual portfolio objectives are far more important. Diversification and a disciplined approach are crucial when navigating market cycles, whether we witness a slump or a surprise rally in September.

[1] September Effect: Definition, Stock Market History, Theories

[2] September Effect: Definition, Stock Market History, Theories

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.