Most global indices tend to be ‘market-cap weighted’, meaning that stocks are weighted according to their total market capitalisation (or size). As a result, any index, whether it’s the S&P 500 or FTSE 100, will normally have a handful of stocks that not only demonstrate leadership, but also make up a significant portion of the index’s returns. However, Nvidia and Microsoft’s impact on the S&P 500 is unprecedented.

As bond yields declined earlier this year, the equity market rally broadened in the middle of the second quarter, meaning more stocks started gaining value across a wider range of sectors. However, persistent (or sticky) inflation figures have given the ‘higher for longer’ mantra more steam, which has led to the narrowing of the rally once again and focus back on US-mega technology stocks.

The S&P 500 continued to hover around record highs throughout the second quarter of this year, with Nvidia briefly overtaking Microsoft last week to become the world’s most valuable company with a market capitalisation of $3.3 trillion.1 This is truly notable, considering Nvidia was the 18th largest company on the S&P as recently as October 2022, worth less than $300 billion.2

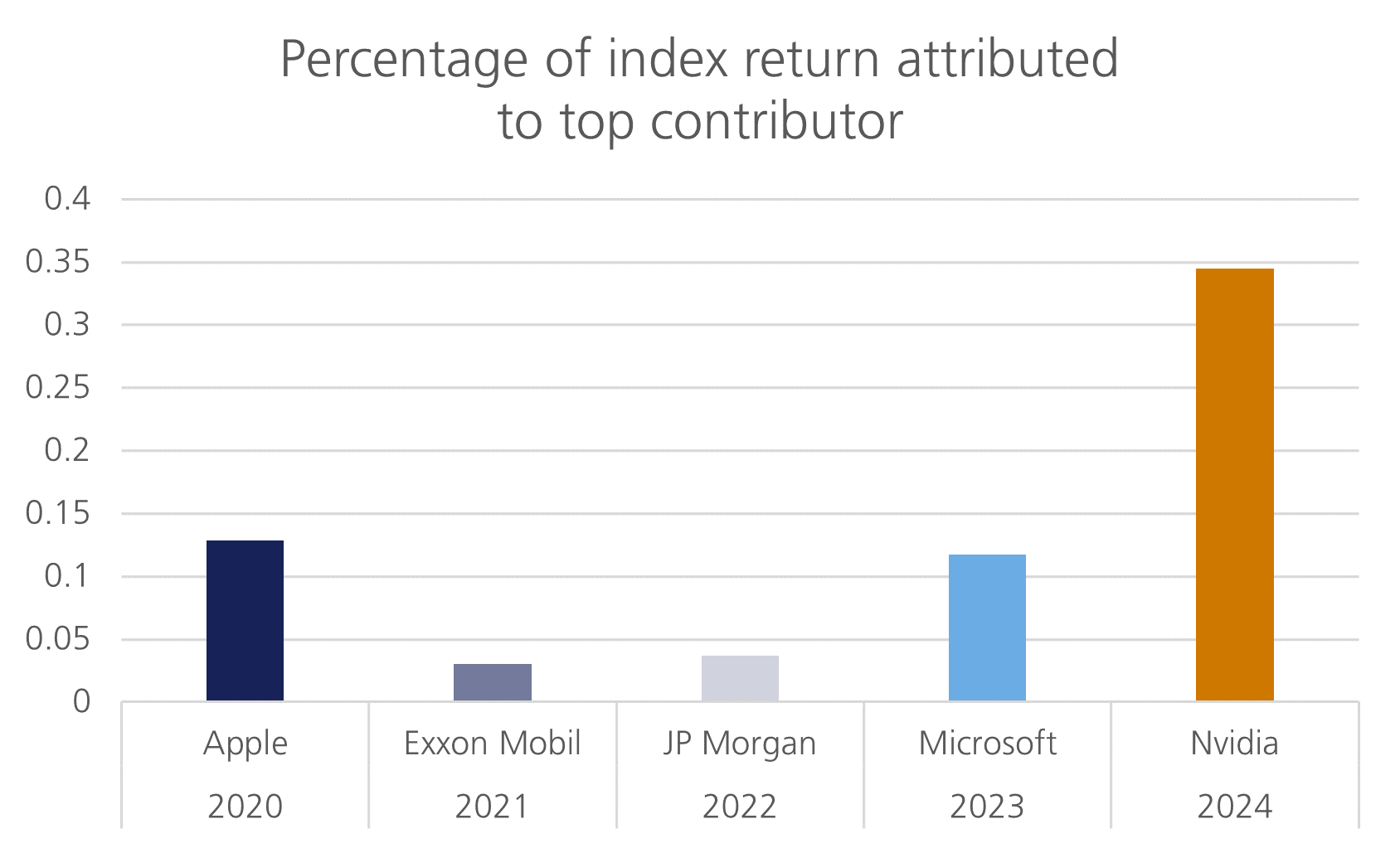

The company has added $2.1 trillion in market cap this year alone, accounting for a staggering 35% of the S&P 500’s gains so far this year.3

The exponential growth of this artificial intelligence (AI) chip company is remarkable, with numerous analysts saying they have never known of another example of a large company grow so fast. Nvidia’s rapid growth is driven by its dominance in AI chips, benefiting from the increasing demand for chips used in training and running AI models like ChatGPT.

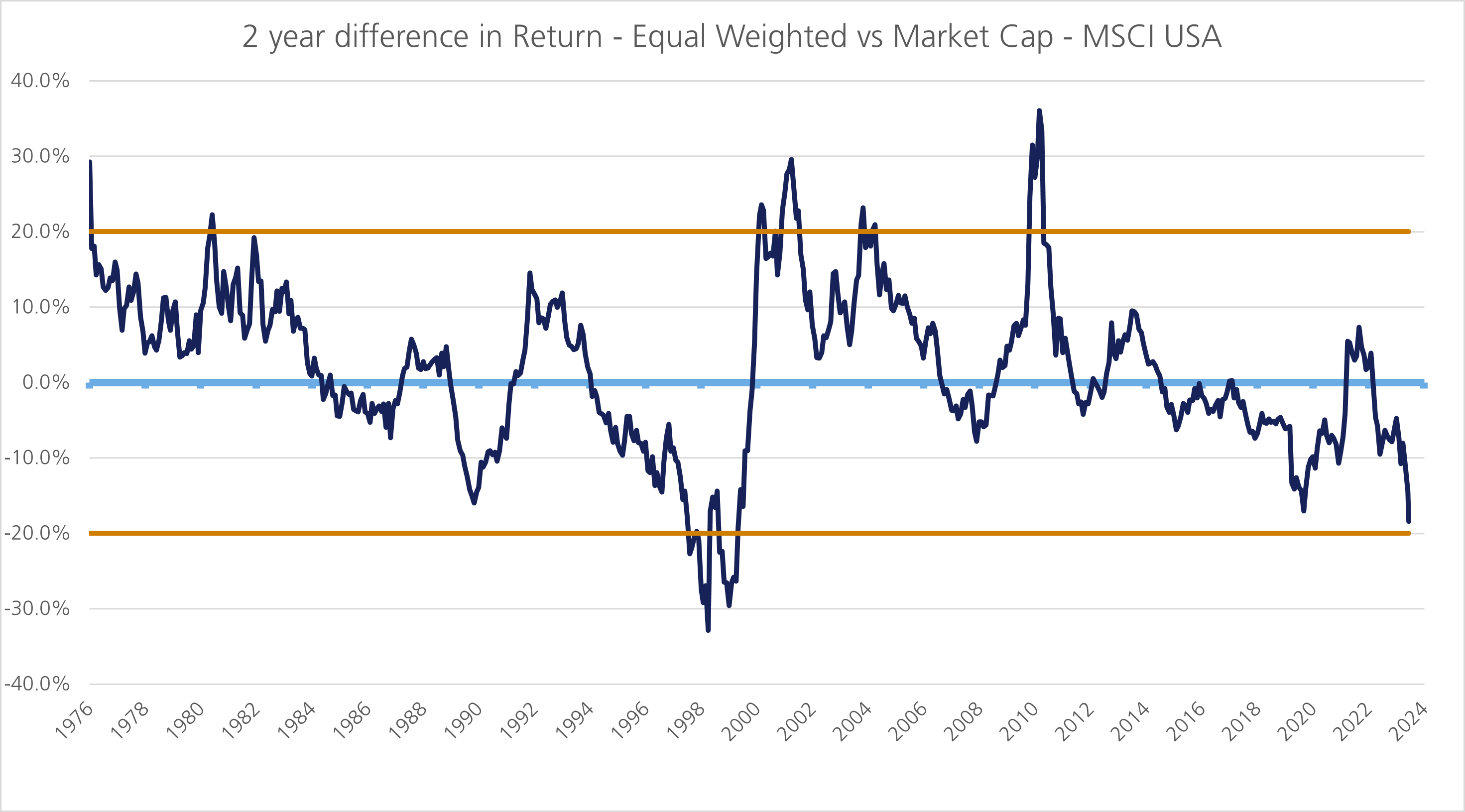

To further demonstrate the narrowness of the US market, the S&P 500 equal weighted index – where each stock is given the same weight regardless of its market capitalisation – is up 4.9% through 26 June, whereas the market cap-weighted S&P 500 – where stocks are weighted according to their total market capitalisation – is up 15.6%.

Historically, there have been periods when stocks contributed close to 2% to an index’s returns, but this tends to happen when the index performs strongly overall. (See chart below.) For example, not owning Microsoft in 2023 could have curbed performance, but as the rest of the index rose 18% that year, investors would have benefited from being diversified. But it’s a different story this year, as Nvidia’s contribution to index returns is astounding. Historically, other stocks catch up with the outperformers, and we expect this time will be no different.

There are several factors driving this. As global central banks engaged in the fastest rate hiking cycle in decades, the large technology companies have benefited simply because they have substantial amount of cash on their balance sheets which is collecting higher interest. The economic sensitivity of higher interest rates doesn’t impact them. For them, it’s all about the fervour surrounding AI, enthusiasm that doesn’t look like it’s going to end anytime soon. Right now, Nvidia, Microsoft and Apple—each worth more than $3 trillion – are in a race to become the world’s most valuable company, and some analysts believe the race to hit $4 trillion will be front and centre over the next year.

As we approach the end of the quarter, we have seen sharp moves up and down in Nvidia, which could well be a result of index re-balancing. But as equities become narrow and concentrated, these moves are significant. It is noteworthy than in the face of high interest rates, inflation, supply chain shocks, geopolitical tensions, elections, a China slowdown and debt refinancing cliffs, markets continue to hit all-time highs. Some point to history that drawdowns occur without warning or a catalyst, and yet we’ve seen markets proven to be immune to tighter fiscal conditions and a weakening economic backdrop.4

The US now accounts for over 60% of the MSCI All Country World Index, yet only makes up around 25% of the world’s GDP. Out of every dollar invested in the S&P 500, 29% goes into the top five stocks.

The narrowness of the rally is unprecedented and is driving this divergence. Whilst undoubtedly US companies – and technology in particular – will continue to drive equities for the foreseeable future, diversifying and investing in quality companies is essential for any long-term investor, especially as AI will potentially benefit all those that embrace it.

[1] Bloomberg, Deutsche Bank

[2] Bloomberg, Deutsche Bank

[3] Bloomberg, Deutsche Bank

[4] Goldman Sachs

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.