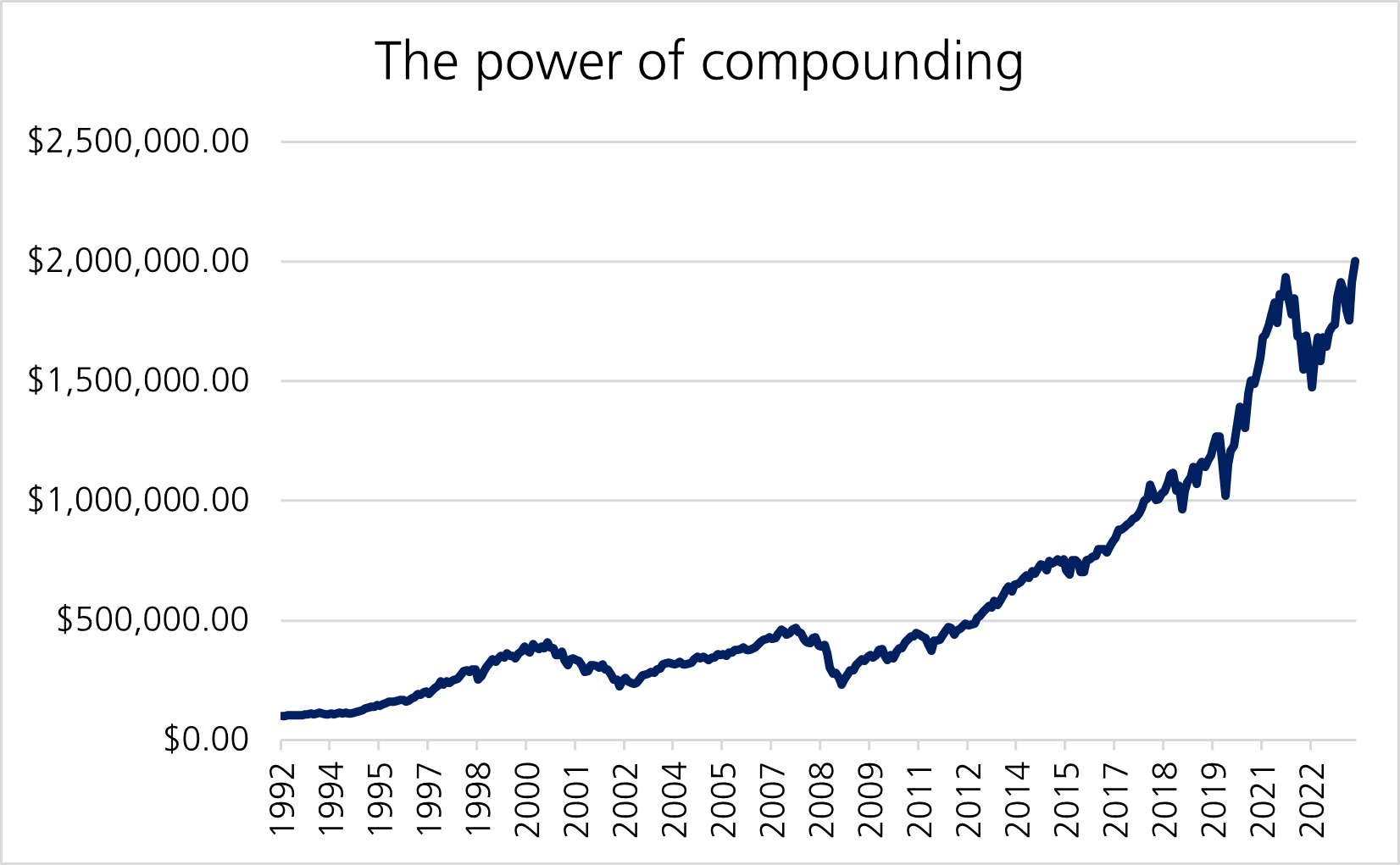

Albert Einstein allegedly once described compounding as the eighth wonder of the world and one of the most powerful forces in the universe. Compounding – when your returns from the previous period are added onto the next period (and again and again) – is indeed a powerful force and a crucial part of long-term investing. While many can grasp the maths behind compounding, it is very hard to visualize over the long-term as the numbers become so large.

To benefit from compounding, investors must remain invested. If you invest £1,000 on day one and see a 10% annual return, in 12 months you will have £1,100 invested. If you experience the same 10% gain next year, your investments will be worth £1,210 at the end of year two. If you were prescient enough to have invested $100,000 in the S&P 500 at the beginning of 1993, you would have about $2 million at the end of 2023. This is a return on investment of 1895%, or 10.1% per year.

This year, the S&P 500 continued to hit record highs, driven by a small number of technology-focused companies in the US benefiting from swirling euphoria over artificial intelligence (AI). The exponential growth these companies have experienced is remarkable—chipmaker Nvidia accounted for 35% of the S&P 500’s total returns in the first half of the year. While it is not uncommon for a few stocks to dominate leadership in an index and make up a significant portion of an index’s returns, Nvidia and Microsoft’s impact on the S&P this year is extraordinary.

Although the focus this year has been on a few stocks, we advise investors to think more carefully about the importance of buying stocks with a proven track record of compounding earnings over time. The focus on a few large technology companies means these compounding stocks have actually become cheaper on a valuation basis. When equity market rallies broaden out to include other sectors and geographies, as opposed to just US mega technology companies, we could then see renewed interest for these quality compounders. Over time, this should drive their stock prices higher.

Conducting thorough research, being comfortable with occasionally missing out and avoiding over-diversification across every sub-sector or market are the cornerstones of our approach.

We minimise unnecessary trading and have adopted a long-term, disciplined approach, as we believe this will help provide the best risk-adjusted returns over the long-term.

Rather than simply investing in an index, we focus on a smaller number of high-quality companies with long-term compounding characteristics. This allows us to benefit from compounding and experience growth potential, as both the initial principal and accumulated interest - from the dividend or the company keeping its cashflows to re-invest at high internal rates of return - allow the investment to grow and increase wealth over time.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.