Central banks’ rate cutting cycles are underway with every data point analysed to determine the speed and scale of future adjustments. Consumer behaviour is a critical factor in shaping central bank decisions. Following last month’s significant rate cut in the United States, market participants are wondering if the Federal Reserve (Fed) anticipates a notable rise in job losses in coming quarters.

When consumer confidence drops, people tend to reduce non-essential spending with big ticket purchases like cars and home renovations being the first to decline. To that effect, in recent weeks we have seen some notable headlines from several car manufacturers.

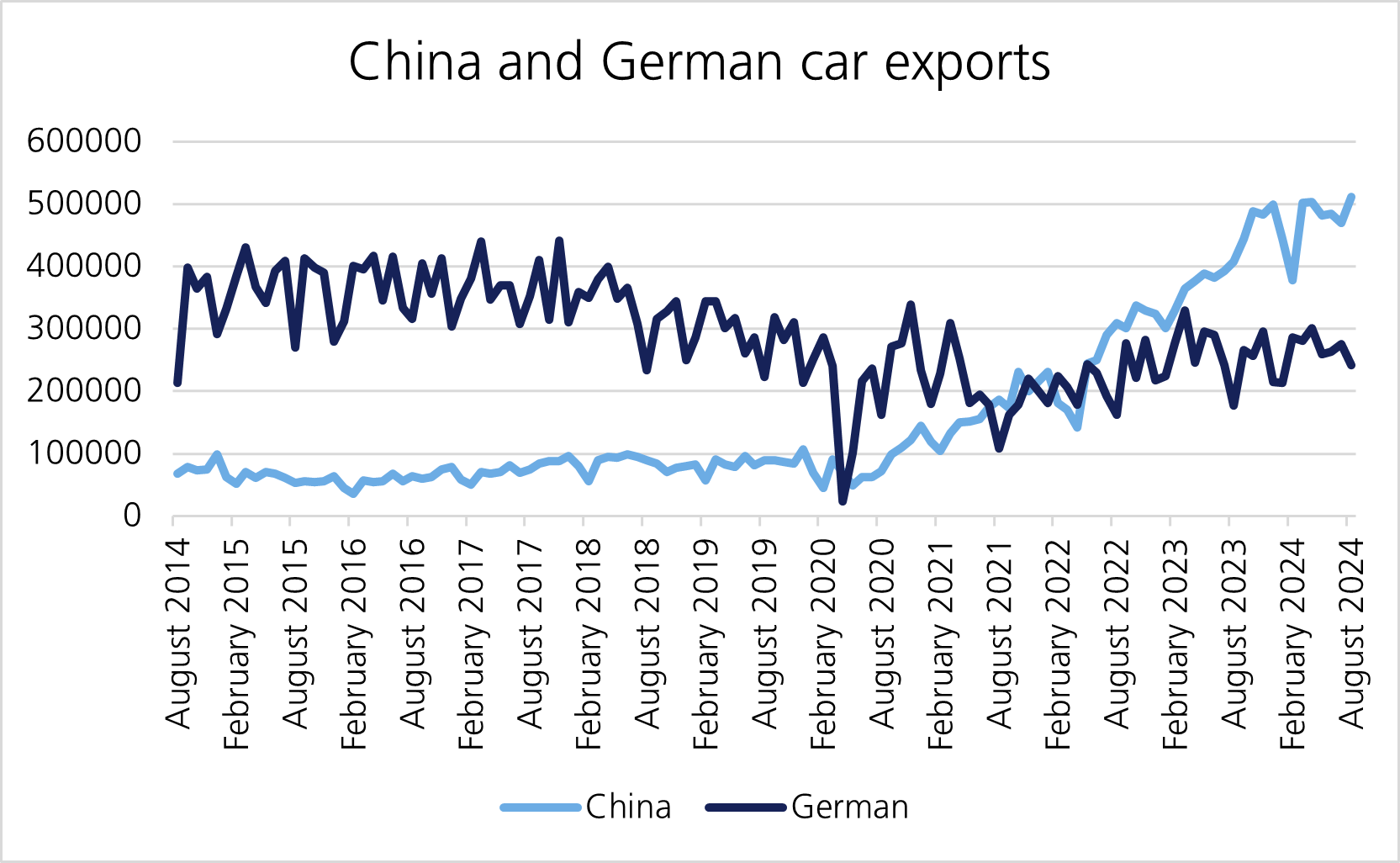

Volkswagen is reportedly considering closing some factories in Germany for the first time in its 87-year-history as it seeks to cut costs due to competition from cheaper Chinese electric vehicles (EV).1 In mid-September, car manufacturer Stellantis said it will stop production of its fully electric Fiat 500 for four weeks as European orders lag,2 later extending the suspension until 1st November.3 Western manufacturers are also experiencing dampened demand in China, the world’s biggest automotive market, as Chinese consumers choose local brand names. BMW, GM and Toyota have all lost market share in the mainland,4 while Mercedes-Benz’s third quarter EV sales fell by almost a third compared to the same prior year quarter due to soft demand from China.5

Given these developments, it is worth considering whether these events signal signs of a broader downturn in consumer spending, or if these challenges are more specific to the automotive industry?

Several long-standing factors have been impacting the global automotive industry for a number of years and it may be a combination of these factors contributing to the current slowdown. However, it remains important to step back to look at the wider picture.

During the pandemic, demand for second hand cars surged as people wanted to avoid public transportation, while the industry was crippled with semiconductor shortages. This sent second hand car prices through the roof. As life gradually returned to normal, there was less demand for second hand vehicles. As such, prices have steadily declined since the end of 2022.

The broader trend is not showing any signs of reverting. However, we may see an uptick in demand on a smaller scale in coming months as the devastating destruction left by Hurricane Milton will result in a lot of written-off cars that will need to be replaced.

The Russia/Ukraine war has had lasting impacts on the European car industry, such as supply chain disruption, higher energy and raw material costs. They have had to adapt quickly to sort supply chains and deal with higher energy and material costs, all of which weighs on production and profitability.

Parameters by European regulators on fossil fuel car production have become increasingly stringent, as the EU aims to phase out internal combustion engines and reduce greenhouse gas emissions to combat climate change. The EU has established strict CO2 emissions limits for new cars, effectively pressuring automakers to shift from fossil-fuel cars. Despite regulatory pressure, consumers are not sold on switching as EVs are too expensive, the charging network is insufficient and concerns over reliability remain.6

In addition to the war in Ukraine, Europe has had to grapple with China’s strengthening foothold on the global EV sector, which has been cannibalising Europe’s auto industry. China has flooded the European market with significantly cheaper models than European counterparts as Beijing subsidises its EV industry. It led the European Commission to formally launch a probe into the fairness of Chinese EV-production. The European Commission is set to impose additional duties of up to 35% on a range of cars exported to the EU from China, which would be on top of the 10% levy already in place.7 (It is worth noting the EU levies pale in comparison to the 100% tariffs announced by the United States and Canada.)

The recent negative headlines may be a combination of factors rather than simply belt tightening. For now, structural factors are having a greater impact on the automotive industry than consumer trends, as the sector adjusts to an unprecedented period marked by a global pandemic, war and the shift towards EVs. While car sales can be a leading indicator for consumer behaviour, it is important to consider the various caveats affecting the industry rather than simply relying on car sales.

[1] The Driven, https://thedriven.io/2024/09/03/volkswagen-may-shut-german-car-plants-due-to-impact-of-chinese-evs/

[2] EuroNews, https://www.euronews.com/business/2024/09/13/stellantis-pauses-electric-fiat-500-model-production-as-orders-slow

[5] Electrive, https://www.electrive.com/2024/10/10/mercedes-ev-sales-down-by-almost-a-third-in-q3/

[7] GMF, https://www.gmfus.org/news/eu-and-its-ev-duties

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.