This week, President Donald Trump announced sweeping tariffs that will reshape trade relationships with the United States. The new tariff regime is more severe than expected, and extraordinary, both in terms of scale and how they were calculated.

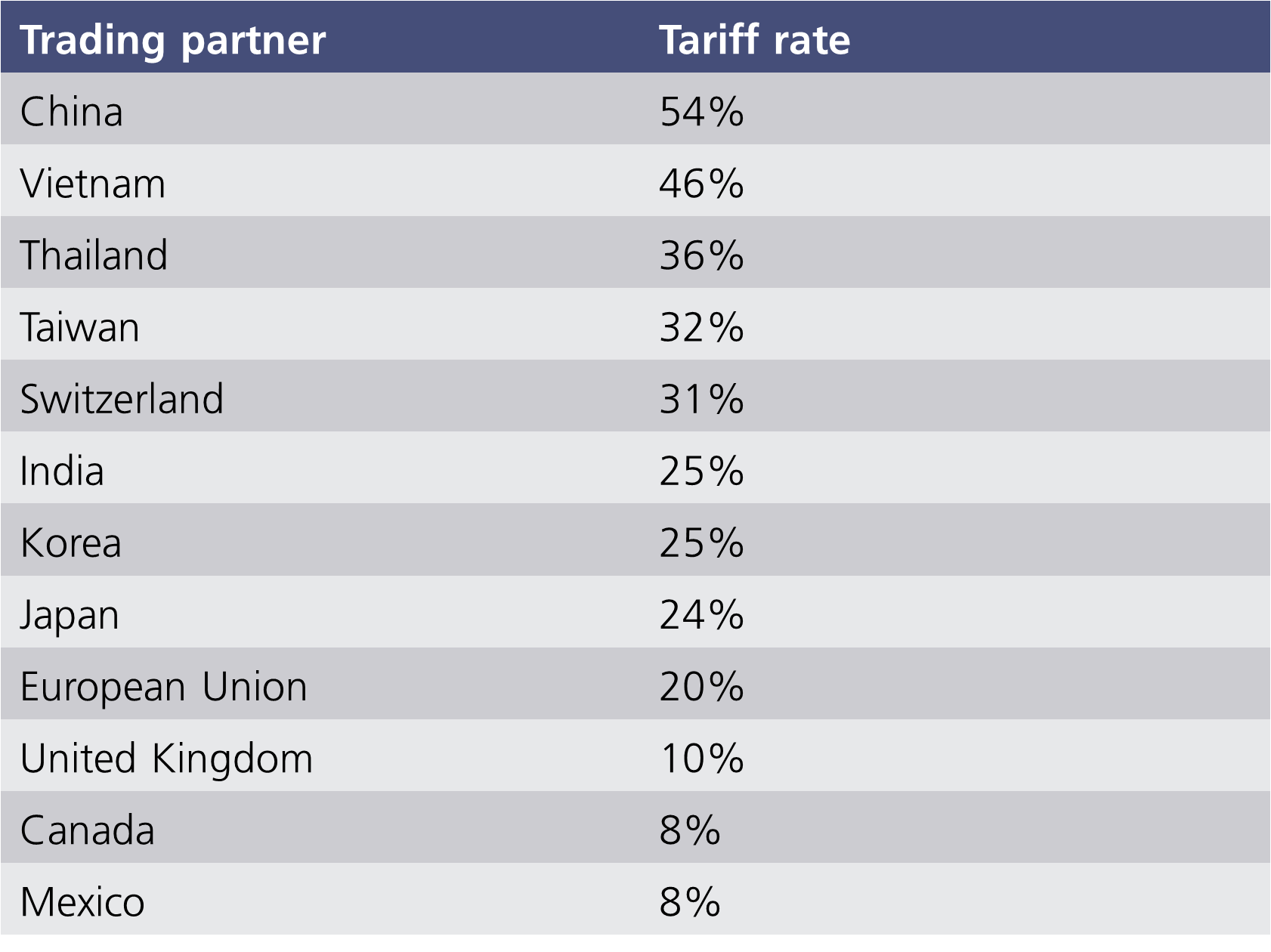

Trump announced a baseline 10% tariff on all countries and higher rates for certain regions. These higher rates exceeded expectations. Asia, particularly China and Vietnam, face the largest increases. European tariffs were broadly in line with expectations, with 20% on the EU and 10% on the UK. The table below shows what the latest announcement means for various countries, but this is not the full list.

The announcement has elicited strong reactions both domestically and internationally. So far, China is the only country to announce retaliatory moves of 34% tariffs on US goods from next week. In theory, the baseline tariffs do not come into effect until 5 April, with any additional reciprocal tariffs due to come in on 9 April. This allows for negotiations, and hopefully, the US will accept concessions before, or soon after, these tariffs come into effect. We have seen Treasury Secretary Scott Bessent urge countries to not retaliate, even suggesting these countries come to the negotiating table. No one wants a full-blown trade war, which would send trade volumes down, strain global growth further, increase inflation and could ultimately lead to a recession. This would complicate the task for central banks further with future rate cuts in the balance.

The extent of the impact will depend on how the world reacts in coming weeks. Economists estimate US GDP could reduce by 1-to 1.5% over the next 12 months and expect inflation could rise by 1-2%. This could result in a global growth shock, adversely impacting risk assets across the world.

Equity markets have seen a risk-off reaction to Trump’s tariff announcement, with major US indices declining by around 5-6% by the close of the day on 3 April, and are indicating a further 3% drop at the time of writing. Since Trump’s announcement on 2 April, Asian markets have seen quite diverse moves. Vietnam lost over 8%, Japan around 6% and China under 1% in local terms through 4 April. We do expect heightened volatility in coming weeks, especially as news evolves on how other countries retaliate. Currency markets are also showing significant moves, where we have seen the US dollar sell off versus the pound, euro and yen by around 1-to-2%. Uncertainty over tariffs, along with concerns about the impact on US growth, mean the dollar has lost its safe-haven status for now. This is unusual, as historically, when we go through periods of heightened market volatility, the dollar usually rallies, which offsets some of the dollar-denominated equity drawdowns. So far this year, the dollar index is off around 6%.

Defensive sectors are outperforming, with utilities and consumer staples holding up, along with real assets. Energy faces large drawdowns as oil prices are down by over 10% on concerns global growth will take a hit.

Bond yields have fallen as the market digests the impact of tariffs. Short-dated bonds are outperforming, with growth risks driving investors to increase the odds of rate cuts. Ten-year Treasury yields have fallen by more than 0.2% to levels below 4% with similar moves seen in bunds, gilts and Japanese government bonds. Yield curves have steepened a touch as longer maturity bonds underperform on a yield basis, given concerns about longer-term inflation.

The long-term impact of these tariffs could be significant, especially as the market has taken Trump’s message to be a withdrawl from global trade. As a result, we expect markets to continue experiencing volatility. Trump’s tariffs have raised concerns about a trade war, inflation and a global slowdown, and markets will move on headlines. However, we are hopeful these tariffs are more of a tool to get countries to the negotiating table. Our investment committee has been monitoring the developments around tariffs closely and stands ready to act. The Trump administration has been a source of market noise, but this volatility could result in longer-term investment opportunities.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority Registered in England and Wales: OC329392. Registered office: 14 Cornhill, London, EC3V 3NR. LGT Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Registered in Scotland number SC317950 at Capital Square, 58 Morrison Street, Edinburgh, EH3 8BP. LGT Wealth Management Jersey Limited is incorporated in Jersey and is regulated by the Jersey Financial Services Commission in the conduct of Investment Business and Funds Service Business: 102243. Registered office: Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management (CI) Limited is registered in Jersey and is regulated by the Jersey Financial Services Commission: 5769. Registered Office: at Sir Walter Raleigh House, 48 – 50 Esplanade, St Helier, Jersey JE2 3QB. LGT Wealth Management US Limited is authorised and regulated by the Financial Conduct Authority and is a Registered Investment Adviser with the US Securities & Exchange Commission (“SEC”). Registered in England and Wales: 06455240. Registered Office: 14 Cornhill, London, EC3V 3NR.

This communication is provided for information purposes only. The information presented is not intended and should not be construed as an offer, solicitation, recommendation or advice to buy and/or sell any specific investments or participate in any investment (or other) strategy and should not be construed as such. The views expressed in this publication do not necessarily reflect the views of LGT Wealth Management US Limited as a whole or any part thereof. Although the information is based on data which LGT Wealth Management US Limited considers reliable, no representation or warranty (express or otherwise) is given as to the accuracy or completeness of the information contained in this Publication, and LGT Wealth Management US Limited and its employees accept no liability for the consequences of acting upon the information contained herein. Information about potential tax benefits is based on our understanding of current tax law and practice and may be subject to change. The tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

All investments involve risk and may lose value. Your capital is always at risk. Any investor should be aware that past performance is not an indication of future performance, and that the value of investments and the income derived from them may fluctuate, and they may not receive back the amount they originally invested.