We dedicate a lot of our weekly Briefs to discussing the latest economic developments and how these developments are likely to guide central bank policy going forward.

Central Banks remain focused on inflation but are keeping a closer eye on labour market developments and specifically, wage growth. To central bankers, that is the best gauge of inflation persistence. Investors are questioning whether interest rates have now reached their peak, which, along with data surprises and central bank comments, have resulted in elevated interest rate volatility. This week, US retail sales came in hotter than anticipated, with futures markets pricing in an increasing likelihood of another Federal Reserve (Fed) hike this year. On the other hand, softening labour market and retail sales data in the UK likely indicates the Bank of England (BoE) is nearing the end of its rate hiking cycle.

Rather than zero in on where rates ultimately land, history tells us generally the best time to add longer dated bond exposure is towards the end of the rate hiking cycle, when rate volatility remains high but starts to moderate over time.

Whilst keeping a watchful eye on the rate hiking cycle is important, understanding how bonds respond to shifts in market interest rates is more critical when managing our underlying portfolios. Bond mechanics allow us to calculate the risk/return trade off and given a large portion of fixed income returns now stems from the income component, we can map out scenarios to determine the expected returns in different scenarios and overlay our expectations to assess expected future returns.

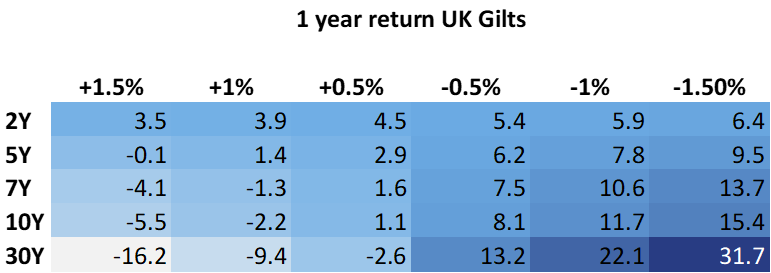

The analysis below is based on market yields as of the 19th October and illustrates the forecasted one-year return for bonds of various maturities. Interest rate sensitivity analyses fixed income price and return fluctuations as interest rates change, assuming no material shift in yield curves.

Estimated 12-month total return based on different yield movements

The table above shows at the current level of interest rates, the power of income is sufficiently strong and largely offsets the risks of interest rates rising. Assuming we have rate cuts of 1%, seven, 10 and 30-year Treasuries and Gilts all offer double-digit returns. In addition, returns for these longer-dated bonds only get more attractive the larger the interest rate cuts.

If interest rates stay higher for longer and if we are indeed near peak rates, current levels offer a solid income whilst providing investors double-digit returns should interest rates start to decline. Government bond yields are the highest they’ve been in 15 years, and now represent a solid stream of income for investors and the potential to make decent capital gains once interest rates move lower.

The dynamics are similar for UK gilts, as seen below.

Estimated 12-month total return based on different yield movements

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.