The uncertain economic environment in 2023 has presented significant challenges for investors. Earlier in the year there was optimism that interest rates were reaching their peak. However, in the third quarter, the resilience of the US economy amid rising interest rates surprised investors, leading to a turbulent summer for financial markets.

The Federal Reserve (Fed) and Bank of England (BoE) paused their interest rate hikes in September, but robust economic growth suggests that rate cuts are becoming increasingly unlikely. This has given rise to the "higher for longer" scenario, indicating that interest rates may remain elevated for an extended period. Amid this market uncertainty, mixed central bank signals, and ongoing volatility, there are opportunities that have emerged which emphasises the importance of staying invested.

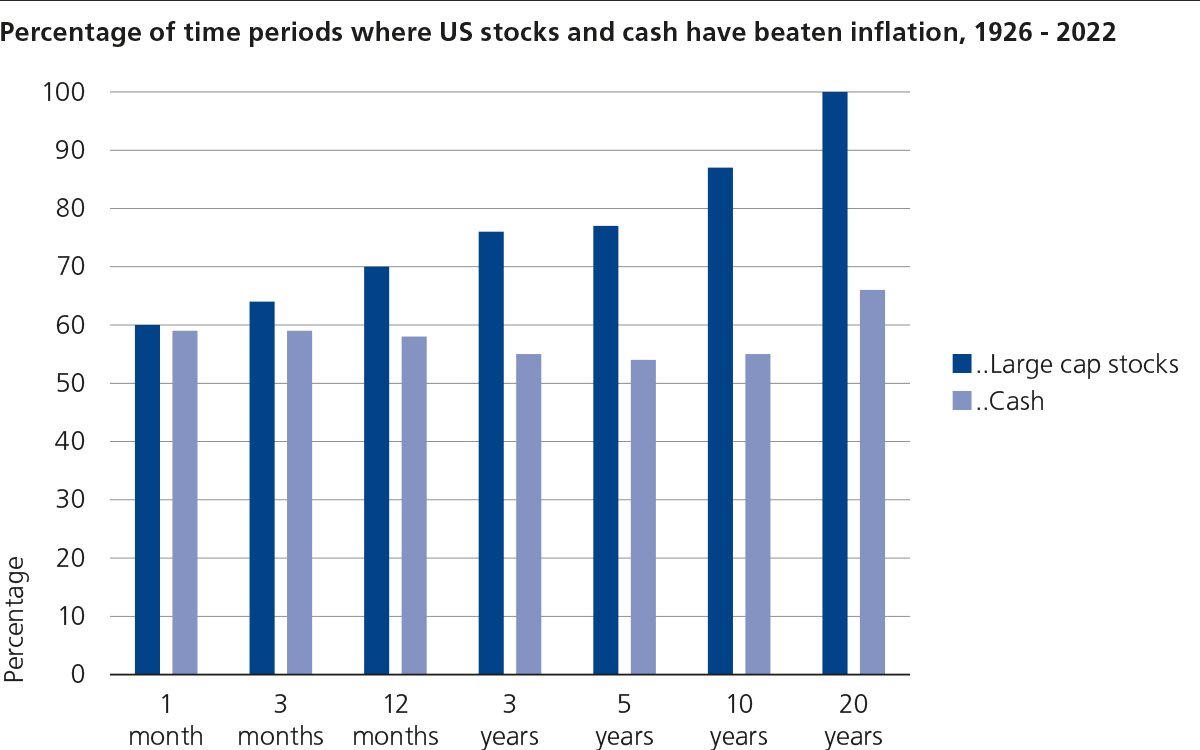

Cash savers are benefiting for the first time in nearly two decades, with some accounts and money market funds offering interest rates exceeding 5%. However, there are drawbacks to holding cash, as it will most likely not keep pace with inflation over any mid-to-long term period, and the real value of cash depends on the rate of inflation. Fixed-rate savings accounts and timed deposits might appear secure but could mean missed opportunities if better investments become available and while high-interest cash accounts are attractive now, they will likely have lower yields when interest rates decrease in the future, which can erode purchasing power.

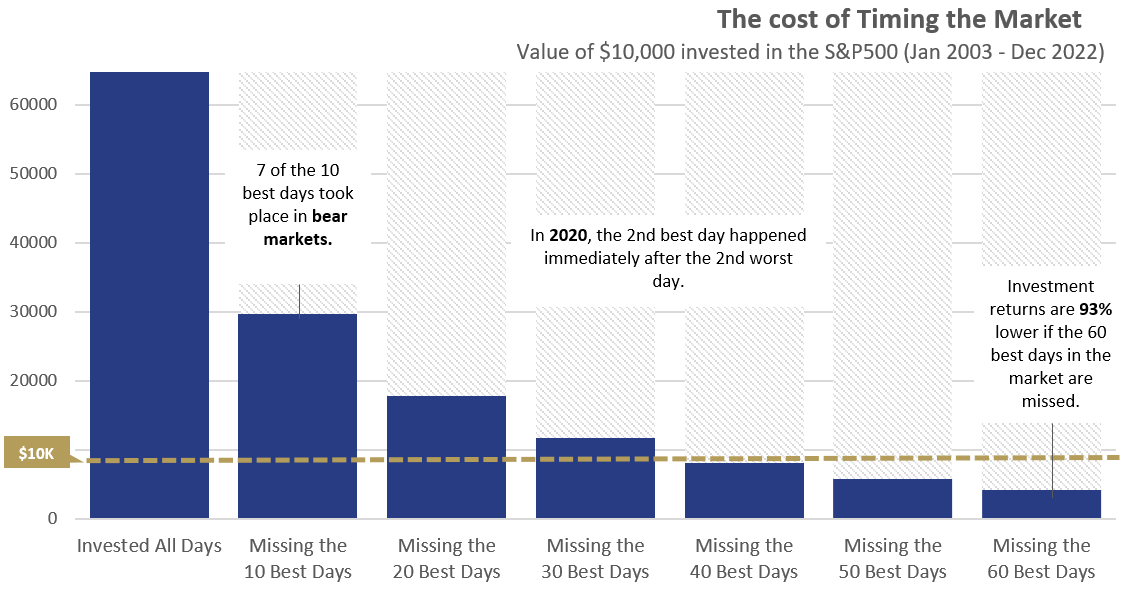

Timing stock markets is exceptionally challenging, even for experienced investors. Market reactions to news are rapid, making it difficult to predict market movements accurately. Missing a few key days in the stock market can have a substantial impact on portfolio returns. Therefore, attempting to consistently pick the best or worst days is a risky endeavour and these attempts to time market entry and exit may result in missing out on potential market rebounds, which can have a significant effect on overall portfolio performance.

In conclusion, the economic landscape of 2023 has given rise to opportunities for a reimagined 60/40 portfolio, combining income from bonds with the potential for long-term equity gains. While cash accounts may seem attractive with their high-interest rates, they may not protect against inflation. Market timing remains a challenging practice, and investors are encouraged to stay invested in a well-diversified portfolio to capture long-term growth and navigate market fluctuations.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.