In what’s been a highly charged week for developed market central banks, for once, attention moved East. Japan, known as the Land of the Rising Sun, finally threw in the towel and followed its peers by abandoning its negative interest rate policy (NIRP), marking the first time the Bank of Japan (BoJ) raised interest rates in 17 years.

After holding rates below 1% since 1995, in 2016 Japan introduced negative interest rates – a policy aimed to stimulate economic activity, since savers are effectively charged to keep their money in a bank. This policy had varying degrees of success, and more recently, speculation mounted that Japan would exit negative interest rates in March or April.

There were several facets to the policy decision. Firstly, the BoJ raised interest rates from -0.1% to a range between 0 and 0.1%. It also tweaked some of its asset purchase programmes to reduce its scope but maintain flexibility. However, BoJ members emphasised their desire to keep a broadly accommodative stance. This was therefore interpreted as a dovish hike, tempering expectations of a significant tightening cycle and as such, the yen fell to its weakest level year-to-date. This proves the adage of “buy the rumour, sell the fact” still holds true. Markets will closely watch further BoJ communication as the yen is currently trading at levels that previously prompted intervention.

Ultimately, it was the Spring Wage negotiation – the annual labour negotiations between employers and labour unions, known as shunto in Japanese – that drove the decision to bring interest rates into positive territory. The first tally of the wage increase rate was 5.3%, much higher than 3.8% in 2023 and well above market expectations. Once smaller firm wage settlements become available, the pay rise rate will likely settle above 4%, a level seen as too high for the 2% inflation target. Overnight, the latest reading of Japanese inflation showed core inflation (excluding food and energy) remained above 3%.

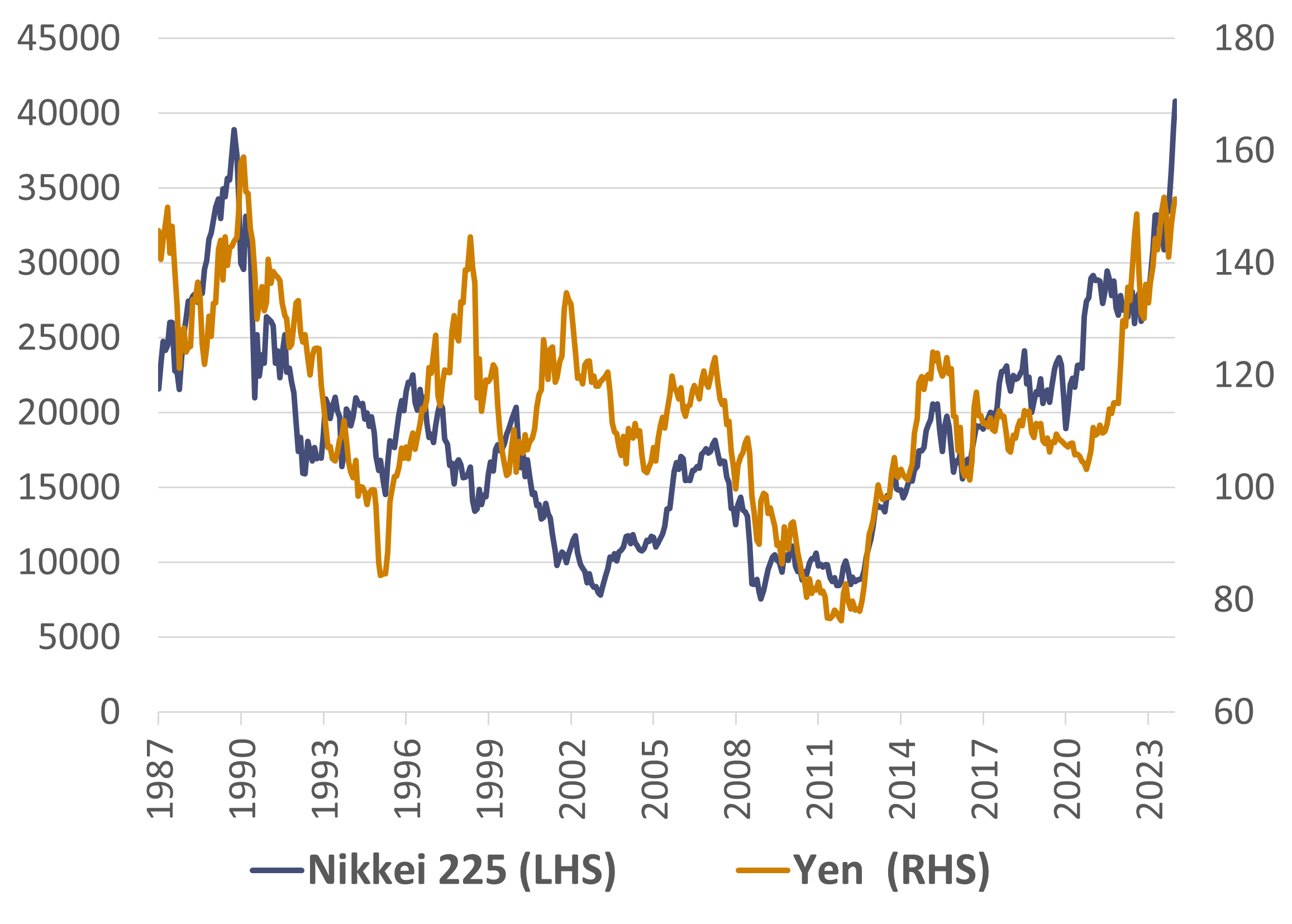

Interest rates are not the only thing rising in Japan. There has been substantial enthusiasm for local equities, with the Nikkei 225 hitting a new all-time high for the first time in nearly 35 years.1 A combination of regulatory and structural changes has encouraged more share-buybacks and dividend payouts, and foreign investors are increasingly putting money to work in Japanese equities.

The Nikkei 225 surpassed a previous all-time high this week while the yen approaches its weakest level since 1990.

The Federal Reserve (Fed) met on Wednesday, usually the main event in all financial calendars. Going into the meeting, some investors expected the Federal Open Market Committee Members would signal for two rate cuts this year instead of three. However, Chair Jerome Powell’s relatively benign view of recent inflation data led him to reiterate the expectations for three rate cuts by December. Given a more upbeat assessment on growth, and a modest upward revision on inflation, the committee indicated that it expects fewer rate cuts in 2025 and beyond.

Meanwhile in the UK, inflation has come down to 3.4% in February from 4% the previous month,2 and is expected to fall closer to its 2% target as the Ofgem energy price cap is forecast to fall by 12% over the next few months.3

The Bank of England (BoE) met Thursday and voted 8-1 to keep rates unchanged at 5.25%.4 Notably, no member voted for a hike for the first time since September 2021.5 While Governor Andrew Bailey said we are “not yet at the point” to cut rates, the votes indicate members are edging closer towards easing policy later this year.

Japan has been busy fighting deflation since the mid-1990s, and as such, was late to the hiking party. While its hiking cycle is likely to be modest, it does mark an ongoing divergence from other developed market central bank counterparts. Indeed, the Swiss National Bank already started the firing gun and eased policy by 0.25% earlier this week, taking rates to 1.5%. For the Fed, BoE and European Central Bank (ECB), the debate continues to circle around the timing and magnitude of rate cuts. It feels appropriate that as the rates rise in the Land of the Rising Sun, the sun is setting on the Fed, BoE and ECB’s rate hiking cycles.

[1] Bloomberg

[2] Office for National Statistics

[3] Ofgem, https://www.ofgem.gov.uk/energy-price-cap

[4] Bank of England, https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2024/march-2024

[5] Bloomberg

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.