With springtime upon us, we are seeing blossoming flowers and are hopeful for better weather after a particularly wet year in the UK. Many are eager to dust off their barbecues or enjoy picnics outdoors. While the image of that seems idyllic, usually an unwelcome fly or wasp comes and spoils the enjoyment of our Pimm’s and lemonade. For Jerome Powell and other members of the Federal Reserve (Fed), the Consumer Price Index (CPI) print this week was well and truly a fly in their ointment.

Coming into this year, after the swiftest hiking cycle in decades, the Fed amongst many other central banks were expecting the global economy to achieve a soft landing. In turn, this would allow them to cut interest rates in a controlled manner as economies grew at a modest pace while inflation gradually moved closer to their 2% target. It was only at their last meeting on the 20th of March where Chair Powell provided a sanguine tone, despite price pressures building in the first two releases of the year. He stated that “We didn’t excessively celebrate the good inflation readings we got in the last seven months of last year” and that “we’re not going to overreact as well to these two months of data, nor are we going to ignore them.”1 The median projections for interest rates also showed that the Federal Open Market Committee members still expected to reduce interest rates by 0.75% over the course of 2024. This reassured investors despite the ongoing disruption to shipping lanes and rising commodity prices.

However, given the bumps in the road of the disinflationary path, this meant the US CPI report released on Wednesday this week was a focal point for markets and central bankers. In March, the consumer price index rose by 0.4% month over month, both on a headline and core basis. On an annualised basis, this means that core inflation remained at 3.8% while the headline data shot up from 3.2% to 3.5%.2 The release represented another upside surprise and brings to mind a quote, sometimes attributed to Ian Fleming: “Once is happenstance, twice is a coincidence, three times is a pattern”.3 The pattern now shows that on a three-month annualised basis, a measure used to emphasise recent trends, core inflation is running at a pace of 4.5% compared to 3.3% in December. Such a sharp increase is likely to give central banks pause for thought.

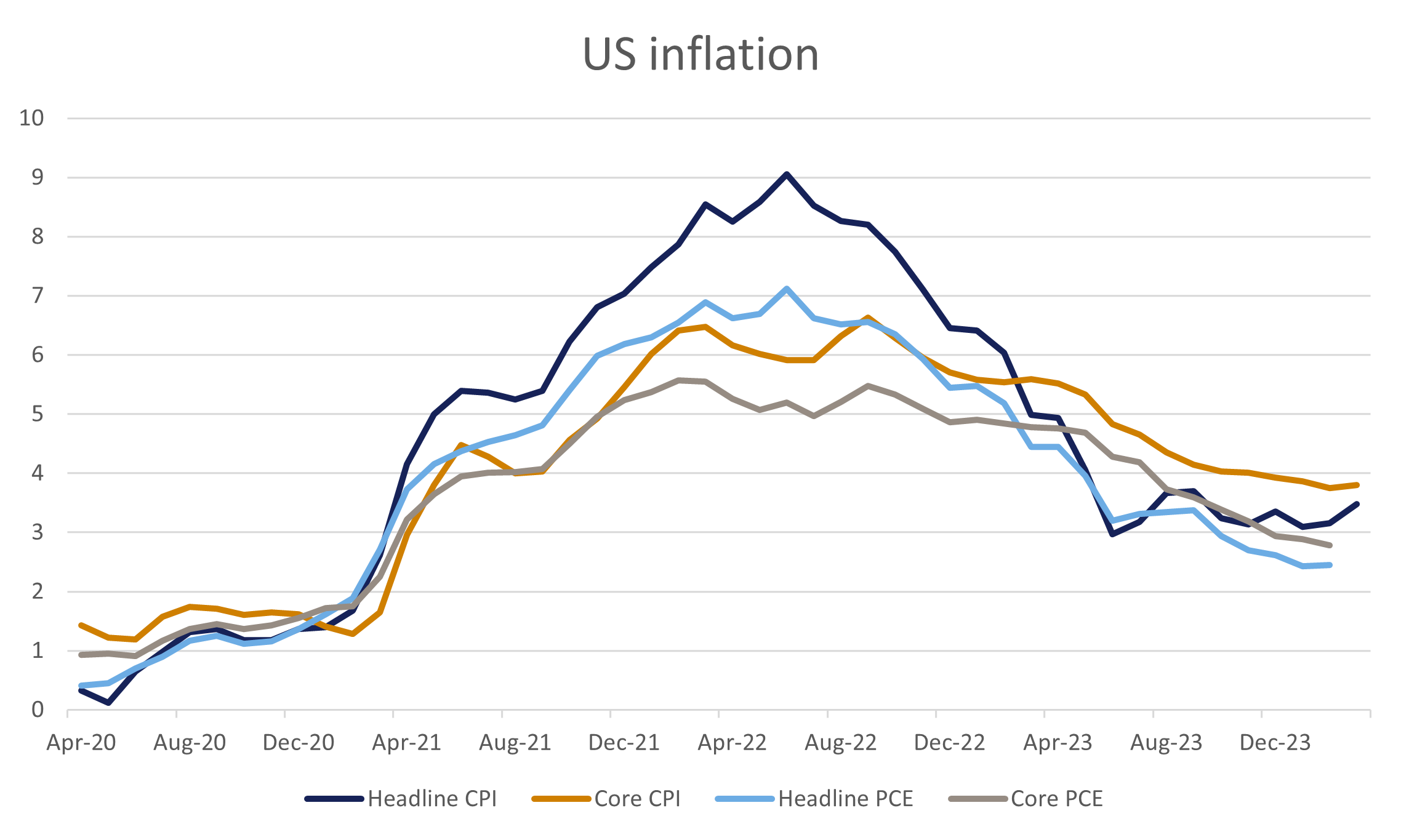

Consequently, investors have moved to price in the first 0.25% rate cut in September from June or July, with another one expected in December. This means investors are pricing a total reduction of 0.5% for 2024. However, given the upside surprises in prices and robust economic activity, some are questioning whether we are now embarking on a new inflationary period, thus requiring no cuts at all. While these concerns are palpable, it is worth bearing in mind that headline inflation as expressed by CPI has remained between 3 to 4% since June last year and core price pressures have been trending lower. Meanwhile, the Fed’s preferred measure, Personal Consumer Expenditure remains below 3% annualised on a headline and core basis.4 The inflation shocks over the last few years have been driven by supply shocks during periods of strong demand and evidence continues to point to a significant recovery in supply chains.

While oil prices have risen by around 20% this year to $85 a barrel (WTI basis), they still remain well below the highs of 2022, when Russia invaded Ukraine.5 The recent strength has been driven partially by concerns of escalation in the Middle East, but also by robust consumer demand. Typically, higher gasoline prices for the US consumer result in less expenditure elsewhere as real incomes get squeezed. As such, the strength of the labour is another key determinant. While job gains have been solid this year, the number of vacancies has been trending lower. This has also meant the so-called quits rate, a leading indicator of wage growth, has declined to pre-pandemic levels. The increase in immigration in the US has had a notable effect on labour supply and likely means that the Fed does not have to wait for unemployment to rise before cutting interest rates.

In summary, while the evidence does not suggest we are about to embark on a new inflationary regime, it does suggest that we may need to navigate a period of elevated inflation for some time. This coincides with a backdrop of more robust growth, which is certainly a positive challenge to grapple with. Consequently, the Fed can afford to delay some of its rate cuts as it awaits further clarity on the path of inflation. On the other hand, the European Central Bank (ECB) communicated this week that it still expects to be in a position to cut its rates in June given the disinflationary trend there. As a result, this week’s developments confirmed that policy among developed market central banks is likely to deviate further over the course of the year.

[1] Federal Reserve, https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20240320.pdf

[2] Bureau of Labor Statistics

[3] Ian Fleming, Goldfinger, 1958. Note Fleming’s original version states ‘three times is enemy action’.

[4] Bureau of Economic Analysis

[5] Bloomberg

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.