Across the pond, Donald Trump convincingly defeated Nikki Haley on Super Tuesday, making a rematch against President Joe Biden in November all but certain. Pundits expect Trump’s campaign will now focus on Biden and paint a dark picture of the state of the country since he left office.

Immigration, inflation and international affairs will no doubt be front and centre. If Trump wins, many expect him to run a very insular-type White House and turn the focusing inward, not outward – his divisive slogan is “Make America Great Again” after all.

Further afield in Japan, there has been a big drive by the Tokyo Stock Exchange to tempt investors back into the local stock market by improving corporate efficiency.

The bourse has told companies to increase profitability or risk being de-listed, a move that has resulted in more share buybacks and dividend payouts. The government also aims to double the tax-free amount retail investors can put in the stock market.

These factors have contributed to the Nikkei’s strong performance this year, making it the best performing index globally so far in 2024.

In the UK, the push towards boosting local investment was evident when Chancellor Jeremy Hunt unveiled his Spring Budget on Wednesday. The announcement included plans to introduce a British Individual Savings Account (ISA), allowing an additional £5,000 annual tax-free savings allowance for investments in UK equities on top of existing ISA allowances of £20,000.

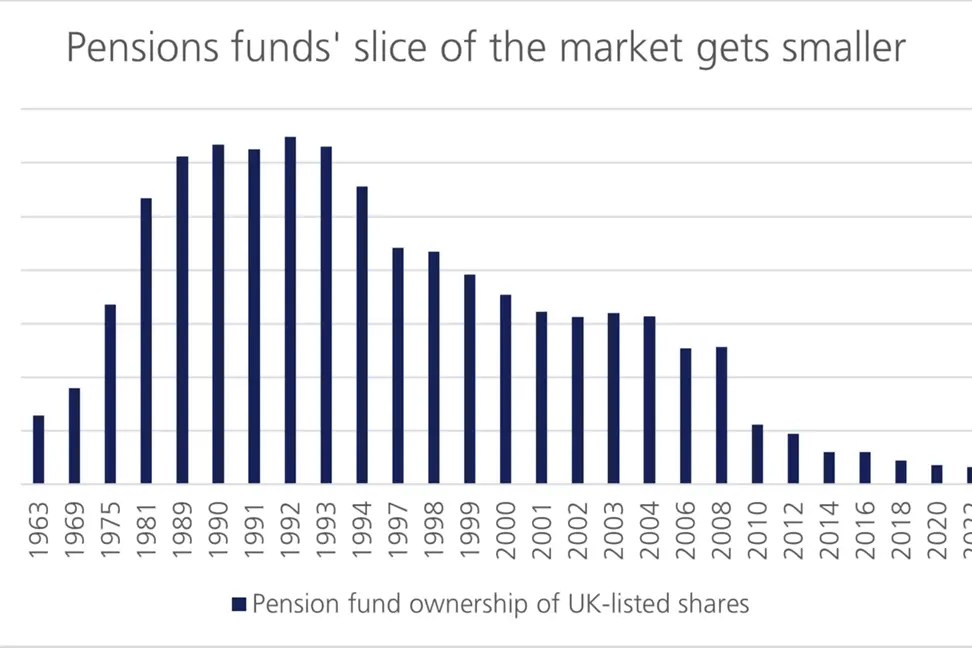

Investors have been pulling money out of UK equities for decades, with pension fund ownership of UK-listed shares steadily dropping since 1992. Hunt’s latest Budget shows the government’s attempts to lure investors back.

Notes:

1. The analysis of pooled nominee accounts allocation of beneficial owners was not updated between 1998 and 2008. Instead, the proportions of the 1997 analysis were used during this period. As such, data between these periods are not directly comparable with data outside this time period.

2. Care should be taken when interpreting charts as the frequency of estimates shown varies throughout the time series.

Hunt’s plans for a British ISA alone are unlikely to bring investors piling back into the UK. Indeed, UK initial public offering (IPO) activity fell to a ten-year low in 2023, with figures for the total number of UK listings almost 50% lower than in 2022.1 But an uptick in corporate activity this week – including cash offers from Nationwide for Virgin Money and Viavi Group for Spirent Communications – shows the UK may well be moving in the right direction. Given valuations of UK companies remain extremely cheap right now, this could present an attractive opportunity for investors.

In a joint statement dated 7th March, Nationwide made a cash offer to buy Virgin Money for £2.9 billion, a 38% premium to Virgin’s prior day closing price.2 Virgin’s board supports the transaction, so it looks likely to go through. Earlier in February, multinational packaging and paper company Mondi sought to expand its footprint with an all-share combination of DS Smith.3

This increased interest in the UK is not just limited to domestic companies, but is attracting suitors from around the world.

In February, Chinese e-commerce company JD.com announced it was in the preliminary stages of considering a possible cash offer for Currys.4 And, on 5th March, Spirent Communications announced they had reached an agreement with US-based Viavi Group for a cash acquisition worth £1 billion.5 Spirent struggled last year with weaker revenue and suffered spending delays in the telecommunications sector and, while the outlook this year remains challenging, Viavi’s takeover bid is promising and could lead to more buyers emerging with improved offers.

We do not necessarily believe Hunt’s measures for a British ISA will bring investors back in droves immediately—the lack of growth companies remains a bugbear. However, the uptick in corporate activity this week is a step in the right direction and could pave the way for further investment into the UK. Given valuations remain cheap, it could present investors with an opportunity to get into the market at attractive levels, to make up a portion of a well-diversified, global portfolio.

[4] Bloomberg, https://www.bloomberg.com/news/articles/2024-02-18/china-s-jd-com-said-to-explore-takeover-of-currys-telegraph

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.