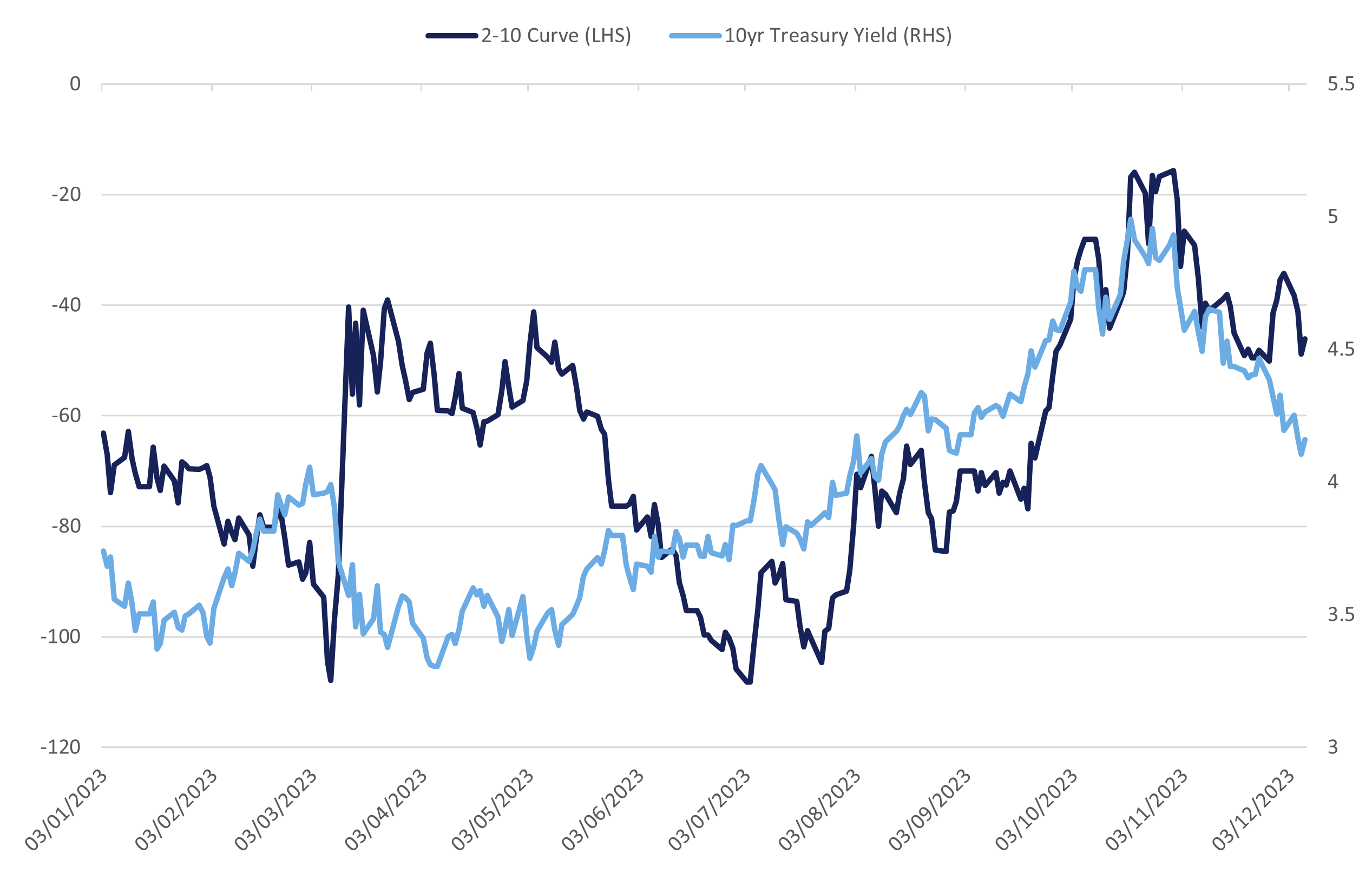

Over the summer and early autumn, the strength of the US economy in the face of the fastest rate hiking cycle in decades surprised market participants. The closely watched spread between two and ten-year Treasuries was the most inverted since the 1980’s at the end of the second quarter.

The growth spurt in the US economy resulted in a more normalised shape of the yield curve, as investors aligned with the central bank mantra that rates would stay higher for longer. The bellwether ten-year US Treasury yield moved sharply higher and touched the 5% mark, the highest level since 2007. Supply side dynamics also helped explain some of the move. Concerns mounted on significant government deficits at a time when the Federal Reserve (Fed) is shrinking its balance sheet.

More recently, economic data has softened, giving investors confidence that the central bank hiking cycle has peaked, and indicating the central banks have managed to engineer a soft landing.

Markets have reacted quickly and are now pricing in five rate cuts in 2024, between 1 and 1.25%.

Fed Chairman Jerome Powell spoke last week, when he tried to temper expectations of next year’s rate cuts. He spoke about rate hikes, but given softening inflation and labour dynamics, investors saw this as rhetoric.

The Fed considers the labour market a good forward-looking indicator about inflation’s stickiness. If wages continue to rise in excess of 4%, this may well keep inflation moderately above the 2% target for a prolonged period of time. Hence any labour market is in sharp focus.

The Job Openings and Labor Turnover Survey (JOLTS) data came in cooler than expected for October, indicating businesses were less keen to take on more staff. The job openings fell to 8.7m in October (9.3 million expected), the lowest level in two-and-a-half years and a sharp drop from the 12 million in the first quarter 2022. This brings the ratio of job openings per unemployed individuals to 1.34, much closer to pre-pandemic levels of 1.2. It is good news for the Fed, which has been trying to get labour demand and supply back in balance for some time. The subsequent release of the ADP employment report also painted a similar picture. A softer labour market means employers are likely to be more discerning about a large increase in pay for staff.

The cooler than expected JOLTS data led to a bond rally, with yields on 10-year Treasuries down to three-month lows of 4.17%. In several of our last pieces (An Early Santa Rally and The Importance of the Yield Curve) we discussed how these extreme moves provided opportunity to purchase bonds. Indeed, bond investors have enjoyed considerable returns since November.

Given the picture the most recent data is painting, investors now appear less concerned about inflation but are keeping a watchful eye on softening growth dynamics. Looking ahead to next week’s calendar, when the Fed, the Bank of England (BoE) and the European Central Bank (ECB) all meet, they may want to push back on some of the market’s ballooning confidence that central banks are about to embark on a meaningful cutting cycle. Stay tuned…

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.