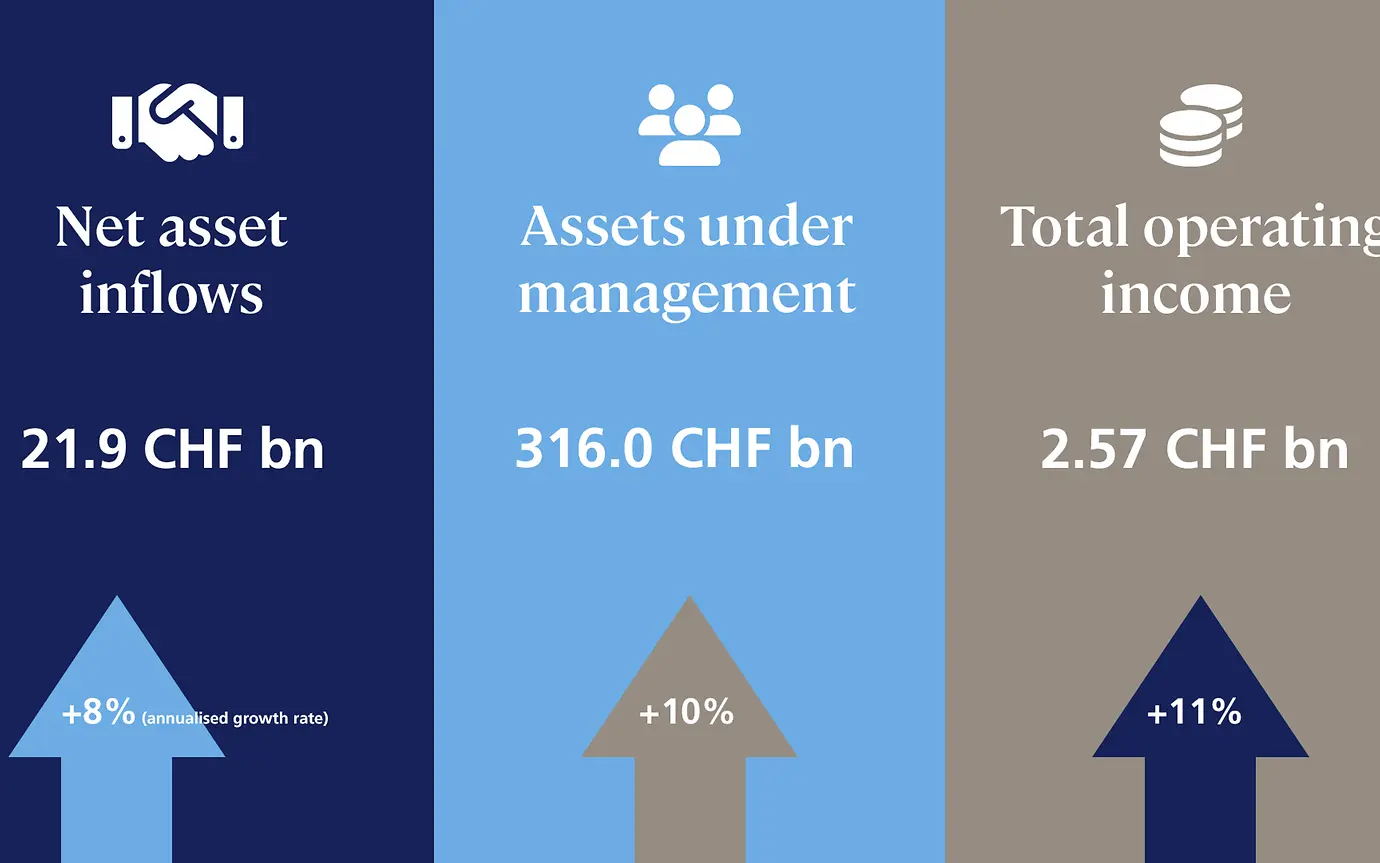

Despite the challenging backdrop of 2023, LGT achieved strong growth and reported a 10% rise in assets under management. This week, we speak to LGT Wealth Management CEO, Ben Snee, following LGT Group’s latest financial results.

Ben Snee: LGT is well-positioned to weather challenging market conditions. The stability of the business can be attributed to a combination of factors. Firstly, our sound financial stability and strength. LGT is very well-capitalised and maintains a high level of liquidity. Secondly, our private ownership allows us to adopt a long-term approach. Finally, our entrepreneurial spirit fosters an environment whereby we continually seek to innovate and invest into the business. As we expand, we remain client-centric and strive to deliver excellent outcomes for all of our clients.

Ben Snee: Following the acquisition of abrdn Capital Limited (aCL), we are excited about the future for the business this year. A clear strategic focus is the integration of aCL into the business, while not losing sight of our number one priority; providing clients with excellent service and ensuring we continue to deliver good outcomes from an investment perspective.

Other priorities include becoming a leader in sustainability in Wealth Management, development of our regional expansion, the continuation of our digital transformation programme and keeping LGT Wealth Management as a great place to work for our colleagues. It will be a busy, but hopefully productive, year!

Ben Snee: We are confident that our commitment to excellent client service and conviction-based investing will drive further growth and support our clients’ ambitions, in spite of market volatility. Our investment strategy is defined by a rigorous process and thorough research. Our team are empowered to act with conviction towards achieving tangible results for clients and our global investment perspective allows the flexibility to explore a wide array of asset classes, sectors, and geographies.

Read the full press release here.